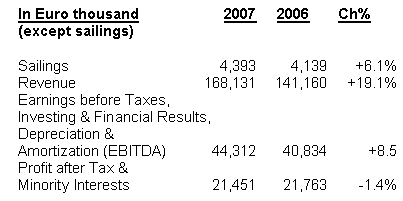

The Board of Directors of Blue Star Maritime S.A. is pleased to announce that the Group in 2007 managed to increase revenue and to improve its already significant operational results despite the increase in the price of fuel oil. In specific, consolidated revenue stood at Euro 168.13 mln against Euro 141.16 mln in the previous year, an increase of 19.1%. Earnings before taxes, investing and financial results, depreciation and amortization (EBITDA) grew to Euro 44.31 mln against Euro 40.83 mln (8.5% increase) while Profit after taxes and minority interests stood at Euro 21.45 mln against Euro 21.76 in 2006 (1.4% decrease).

For fiscal year 2007, following the results of the Company and the Group, the outlook for the current year and the prevailing macroeconomic and market conditions, the Board of Directors will propose to the Annual General Meeting of Shareholders the distribution of dividend of Euro 0.09 per share. Total suggested dividend payable stands at Euro 9.45 mln.

The Groupís key financials for year 2007 compared to the previous year are:

The increase in revenue is mainly attributed to the improvement in total volumes carried in the Dodecanese Islands routes, due to the deployment of car Ė passenger ferry Diagoras throughout 2007 for the first time. The vessel was acquired in July 2006 and was deployed in August 2006. The redeployment of Blue Star 1 from the Adriatic to the North Sea route since 29th of January 2007, was another contributing factor to the significant increase in Groupís revenue. Finally, in the Cycladic routes, where four out of eight vessels of the Group are deployed, the increase in yield obtained per passenger and vehicle carried has contributed to the revenue increase.

The operating profitability (EBITDA) of the Greek domestic market, remained at the same approximately levels compared to the previous year (Euro 35.65 mln in 2007 against Euro 35.88 mln in 2006) despite the increase in total volumes carried and in revenue. This development was mainly due to the high price of fuel oil and an extensive schedule of vessel maintenance that took place in 2007. The increase in operational profitability for the Group compared to year 2006 is contributed to the sound decision of the Groupís management to maintain one vessel, Blue Horizon, in the Adriatic Sea and to redeploy Blue Star 1 in the North Sea. The operating result of both vessels, combined together, has clearly improved in 2007 against year 2006 despite the adverse conditions of the market.

The operating profitability (EBITDA) of the Greek domestic market, remained at the same approximately levels compared to the previous year (Euro 35.65 mln in 2007 against Euro 35.88 mln in 2006) despite the increase in total volumes carried and in revenue. This development was mainly due to the high price of fuel oil and an extensive schedule of vessel maintenance that took place in 2007. The increase in operational profitability for the Group compared to year 2006 is contributed to the sound decision of the Groupís management to maintain one vessel, Blue Horizon, in the Adriatic Sea and to redeploy Blue Star 1 in the North Sea. The operating result of both vessels, combined together, has clearly improved in 2007 against year 2006 despite the adverse conditions of the market.

Net profit after taxes and minority interests stood at Euro 21.45 mln, slightly lower from Euro 21.76 mln in 2006. The decrease in net profits is due to the increase of financial expenses because of the increase of interest rates and the negative foreign exchange differences that arised during the fiscal year 2007. Furthermore, depreciation expenses increased due to the addition of Diagoras in our fleet and at the same time fiscal year 2007 does not include any extraordinary profits from sale of vessels that for the fiscal year 2006 stood at Euro 1.3 mln approximately.

As regards the Balance Sheet and the Cash Flow Statement, Blue Star Group maintains its strong cash position with cash and cash equivalents growing to Euro 51.18 mln compared to 2006 year-end that stood at Euro 42.24 mln. Furthermore, cash flow from operating activities increased significantly and stood at Euro 32.05 mln against Euro 23.77 mln in 2006. At the same time, the Group reduced its long-term liabilities.

Total Equity after minority interests of the Group stood at Euro 228.55 mln against Euro 215.03 mln in 2006.

The long-term liabilities of the Group decreased and stood at Euro 163.59 mln in 2007 against Euro 176.75 mln in 2006. The Groupís Debt to Equity ratio is approximately 0.72 which is considered satisfactory compared to the sectorís average.

Developments in the Sector

On 1st October 2007, according to a decision of competent Greek Authorities, all passenger ships operating on regular services are obliged to comply with the European Directive regarding the use of Low Sulphur fuel. The higher cost of Low Sulphur fuel (approximately Euro 15-20 per m/t) combined to the fact that current fuel prices have reached very high levels, will have a negative impact in the financial results of all companies in the sector.

Traffic volumes

?otal volumes for the Group in 2007, stood at 3,416,382 passengers, 458,611 private vehicles and 159,059 freight units. Compared to the previous year, these figures represent a 1.9% increase in passenger volumes while private vehicle volumes grew by 7.7% and freight units volumes grew by 11.2%, over 6.1% more sailings compared to 2006.

Important developments of fiscal year 2007

In January 2007, the vessel Blue Star 1 was redeployed from the Greece-Italy route to the Scotland-Belgium route in the North Sea. Blue Star 1 commenced successfully its service on the route on 29th January, 2007.

In September 2007, the parent company Blue Star Maritime S.A., sold its properties (office buildings) located in the city of Piraeus and in the town of Rhodes. The total sale price stood at Euro 2.4 mln, enhancing the Groupís cash position.

On October 23, 2007, MIG SHIPPING S.A., a wholly owned subsidiary of MARFIN INVESTMENT GROUP HOLDINGS S.A., submitted a mandatory Public Offer to the shareholders of Blue Star Maritime S.A. in respect of the purchase of the entirety of their common bearer shares with voting rights, at the price of Euro 3.83 per share, in cash.

Important developments after 31.12.2007

On 4th January, 2008, MIG Shipping S.A., announced the

results of the mandatory Public Offer to the shareholders of Blue Star Maritime S.A. According to the announcement, MIG Shipping S.A., MIG and Attica Holdings S.A., held shares representing 84.45% of the Companyís total share capital.

On 26th February, 2008, the Board of Directors announced its decision to merge by absorption Blue Star Maritime S.A. by the Athens Exchange listed Attica Group.

Outlook for the Group

Groupís future outlook for fiscal year 2008 lies in full harmonization with Attica Groupís future strategy following the decision of the Board of Directors of both Companies, to merge by absorption the Blue Star Maritime S.A. by Attica Holdings S.A., as per provisions of articles 69-77a of Common Law 2190/1920, of articles 1 to 5 of Law 2166/1993 and other provisions of commercial law as applicable.

In this context, the Groupís management will continue to examine the development of new routes and the strengthening of the existing ones in the International and Greek domestic market, through the acquisition or building of modern conventional vessels, provided that suitable market conditions develop. The Groupís management is in contact with shipyards for building new vessels.

The Consolidated and Company Financial Statements will be published in the press and will be posted on the Athens Exchange and Group (www. bluestarferries.com) websites today, Thursday 27th March, 2008.

Voula, 27th March, 2008

The Board of Directors

For more information please contact:

Mr. Dionissis Theodoratos

BLUE STAR MARITIME S.A.

?el.: +30 210 891 9820

Fax: +30 210 891 9829

www.bluestarferries.com