LNG carriers start a new energy era

2008-12-23

With new and larger LNG carrie1rs, more gas from the Middle East will be available to consumers in Asia, Europe and North America.

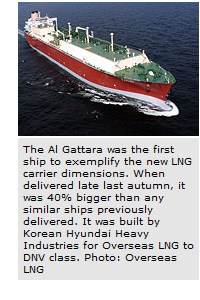

All in all, some 50 LNG carriers – bigger than ever before – will transport Liquefied Natural Gas (LNG) from the enormous gas resources offshore Qatar. The very first one, the Al Gattara classed by DNV, was built by Hyundai Heavy Industries (HHI) in South Korea and delivered late last autumn. The gas it has transported has already been used for cooking in Singapore and Japan.

Since the very first LNG carrier with a cargo volume of more than 100,000 m3 was completed in the early 1970s, these vessels’ size and storage capacity have increased slowly but surely. It took almost 25 years

to pass the next milestone of 150,000 m3.

Now, at one stroke, the global LNG carrier fleet has been given a new dimension. The largest of the new ships tailor-made for the liquefaction plants at Ras Laffan Industrial City in Qatar are some 50% bigger than any previous LNG carrier.

The Al Gattara is 315 metres long and has a loading capacity of 216,000 m3. It is the biggest LNG carrier currently sailing. The first of a chain of even bigger vessels

is to be delivered later this year. A 345-metre-long ship with a loading capacity of 265,000 m3 will then be the biggest.

The Al Gattara is 315 metres long and has a loading capacity of 216,000 m3. It is the biggest LNG carrier currently sailing. The first of a chain of even bigger vessels

is to be delivered later this year. A 345-metre-long ship with a loading capacity of 265,000 m3 will then be the biggest.

Evolution – not revolution

All the new LNG carriers are to be built at the three major South Korean yards – Hyundai Heavy Industries (HHI), Samsung Heavy Industries and Daewoo Shipbuilding & Marine Engineering. This major leap ahead is impressive but is not described as revolutionary – it is more of an evolution when it comes to the containment and propulsion technology involved.

As a representative of HHI, vice president Jae-Keun Ha does not see any major new steps being taken within the foreseeable future: “We have to keep in mind that these leaps have been taken due to the huge gas resources to be exported from Qatar and the new and increasing numbers of LNG processing trains and receiving terminals being built for this purpose.”

Qatar is already the world’s largest exporter of LNG. Its production capacity will be some four times greater once all Qatargas’ ongoing expansions have been completed in two years’ time. Qatar’s export volume will then be three to four times that of the second-largest exporter.

A whole industry has been involved in moving LNG transportation to these new heights, but it is still fair to say that the yards in South Korea have played an essential role. So Mr Ha is perhaps in a better position than most to predict future developments:

“It’s always difficult to look into the crystal bowl,” he says, “but the terminals are the major limitation. We believe that in addition to the Qatar projects, other big projects, such as new ones in Russia and Iran, will decide their ship capacity in accordance with the project’s total economics. However, the capacity of these ships is not expected to exceed those of the Qatar projects. Terminals will still be the limitation. Without new investments in existing terminals worldwide, the maximum is 155,000 m3 for worldwide trade and 170,000 m3 for the Atlantic Ocean trade.”

Optimistic about the future

There are several reasons for being optimistic when you are managing the world’s biggest shipyard’s LNG unit. The whole world needs more energy and available energy is the key element for growth and development. The demand is expected to increase to new heights and LNG’s advantages, such as reduced emissions, cleaner energy, available resources and promising prospects, make the yard optimistic about the future.

“Due to some delays when developing the LNG processing trains in Qatar and the fact that major new projects have not been initiated in other parts of the globe, there is a lack of orders for new LNG carriers at the moment. However, we are sure this is temporary. HHI believes the number of vessels will be doubled by 2015,” says Mr Ha.

He uses other examples to justify this optimistic view: “LNG is an important part of the solution when developing one of the world's largest offshore gas fields, Stockman. It has not been developed as fast as expected, but it will be developed. At the other end of the scale, new production floating terminals or vessels to develop gas fields of restricted size will also be built. In between, there will be a wide range of other gas resources to develop.”

The common element is that most of the gas resources are located far away from the consumers. Liquefying the natural gas and then transporting it by ship is the solution – even more so in the future than today.

“The terminals are the major limitation. We believe that in addition to the Qatar projects, other big projects will decide their ship capacity in accordance with the project's total economics. However, the capacity of these ships is not expected to exceed those of the Qatar projects,” says Jae-Keun Ha, Vice President of Hyundai Heavy Industries.

DNV

|