|

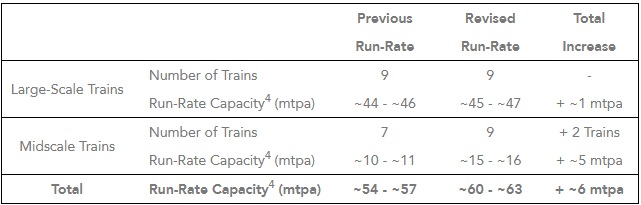

• Announcing positive Final Investment Decision of the Corpus Christi Midscale Trains 8 & 9 and Debottlenecking Project of approximately 5 million tonnes per annum • Growing Cheniere's brownfield LNG platform by >10% to >60 million tonnes per annum of capacity by 2028 and remaining >90% long-term contracted • Planning to increase annualized dividend by >10% from $2.00 to $2.22 per common share for the third quarter 20251 • Expecting to deploy >$25 billion of available cash through 20302 towards accretive growth, share repurchases, balance sheet management and dividends • Targeting >$25 per share of run-rate Distributable Cash Flow3 by the early 2030s Houston - June 24, 2025 Cheniere Energy, Inc. ("Cheniere") (NYSE: LNG) announced today that its Board of Directors has made a positive Final Investment Decision ("FID") with respect to the Corpus Christi Midscale Trains 8 & 9 and Debottlenecking Project ("CCL Midscale Trains 8 & 9") and has issued full notice to proceed to Bechtel Energy, Inc. ("Bechtel") for construction of CCL Midscale Trains 8 & 9. CCL Midscale Trains 8 & 9 is being built adjacent to the Corpus Christi Stage 3 Project ("CCL Stage 3") and consists of two midscale trains with an expected total liquefaction capacity of over 3 million tonnes per annum ("mtpa") of liquefied natural gas ("LNG") and other debottlenecking infrastructure. Upon completion of CCL Midscale Trains 8 & 9, and together with expected debottlenecking and CCL Stage 3, the Corpus Christi LNG terminal is expected to reach over 30 mtpa in total liquefaction capacity later this decade. Increased Run-Rate Production Guidance (4) Cheniere also announced today an updated run-rate LNG production4 outlook, which reflects an increase in the combined liquefaction capacity across the Cheniere platform at Sabine Pass and Corpus Christi by over 10% to over 60 mtpa inclusive of CCL Midscale Trains 8 & 9, CCL Stage 3, and identified debottlenecking opportunities across the platform.

In addition, Cheniere is developing further brownfield liquefaction capacity expansions at both the Corpus Christi and Sabine Pass terminals. The Company expects these expansions to be executed in a phased approach, starting with initial single-train expansions at each site which, if completed, would grow Cheniere's LNG platform to up to approximately 75 mtpa of capacity by the early 2030s. Capital Allocation Plan Update: >$25 Billion of Available Cash Expected through 20302 to Achieve >$25 of Run-Rate Distributable Cash Flow3 per Share With today's FID and the existing share repurchase authorization, Cheniere is on track to meet its previously announced ‘20/20 Vision' capital allocation plan of deploying approximately $20 billion of capital by 2026 and reaching approximately $20 per share of run-rate Distributable Cash Flow ("DCF") (3). Cheniere is increasing and extending its committed capital allocation targets, starting with a planned over 10% increase of its third quarter 2025 dividend from $2.00 to $2.22 per share annualized (1). Going forward, Cheniere expects to generate over $25 billion of available cash through 20302 as of this quarter, which the Company plans to allocate across disciplined accretive growth and shareholder returns in the form of buybacks and dividends, as well as balance sheet management. With this enhanced plan, Cheniere now expects to reach over $25 per share of run-rate DCF3. Cheniere Management Commentary "We are pleased to announce the FID of CCL Midscale Trains 8 & 9 today, an important milestone for Cheniere as we continue to accretively grow our world-class infrastructure platform to over 60 mtpa," said Jack Fusco, Cheniere's President and Chief Executive Officer. "I would like to recognize the Cheniere team, our EPC partner Bechtel, our long-term customers and the regulatory agencies which govern our projects for the demonstrated teamwork, commitment and execution, all of which were critical elements in the successful commercialization and development of CCL Midscale Trains 8 & 9 in adherence to the Cheniere standard. We expect CCL Midscale Trains 8 & 9 to be executed seamlessly with Corpus Christi Stage 3, where Train 1 achieved Substantial Completion in March, and Train 2 achieved first LNG production this month. We look forward to bringing this much needed new LNG supply to market safely, on time and on budget." Zach Davis, Cheniere's Executive Vice President and Chief Financial Officer added "Our upwardly revised run-rate production4 and financial forecasts are a direct result of Cheniere's operational excellence program and continuous efforts to economically debottleneck and optimize our business. Our progress deploying capital towards disciplined accretive growth, opportunistic share repurchases, balance sheet management and growing dividends, combined with today's updates, solidifies the goals of our ‘20/20 Vision' capital allocation plan, and positions Cheniere to deploy over $25 billion of available cash through 2030 to achieve over $25 per share of run-rate DCF." (1) Subject to declaration by Board of Directors. (2) Forecast as of June 24, 2025 and subject to change based upon, among other things, changes in commodity prices over time. (3) Non-GAAP financial measure. See "Reconciliation of Non-GAAP Measures" for further details. (4) Run-rate capacity based on 20-year annualized average of LNG produced, accounting for asset availability, reliability and planned maintenance. About Cheniere Cheniere Energy, Inc. is the leading producer and exporter of liquefied natural gas ("LNG") in the United States, reliably providing a clean, secure, and affordable solution to the growing global need for natural gas. Cheniere is a full-service LNG provider, with capabilities that include gas procurement and transportation, liquefaction, vessel chartering, and LNG delivery. Cheniere has one of the largest liquefaction platforms in the world, consisting of the Sabine Pass and Corpus Christi liquefaction facilities on the U.S. Gulf Coast, with total production capacity of over 46 mtpa of LNG in operation and an additional ~13 mtpa of expected production capacity under construction. Cheniere is also pursuing liquefaction expansion opportunities and other projects along the LNG value chain. Cheniere is headquartered in Houston, Texas, and has additional offices in London, Singapore, Beijing, Tokyo, Dubai and Washington, D.C. For additional information, please refer to the Cheniere website at www.cheniere.com and Quarterly Report on Form 10-Q for the quarter ended March 31, 2025, filed with the Securities and Exchange Commission. Dividends Future amounts and payment dates of quarterly cash dividends will be subject to the determination and approval of Cheniere's Board of Directors. The decision by the Board of Directors whether to pay any future dividends and the amount of any such dividends will be based on, among other things, Cheniere's financial position, results of operations, cash flows, capital requirements, restrictions under Cheniere's existing credit agreements and the requirements of applicable law. Cheniere Energy, Inc. press release

|