|

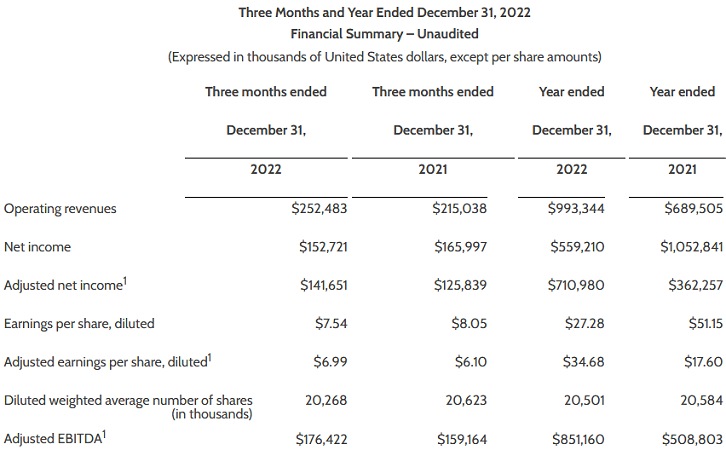

Athens, Greece - 15 February 2023 Danaos Corporation ("Danaos") (NYSE: DAC), one of the world's largest independent owners of containerships, today reported unaudited results for the fourth quarter and the year ended December 31, 2022. Highlights for the Fourth Quarter and Year Ended December 31, 2022: • Adjusted net income1 of $141.6 million, or $6.99 per share, for the three months ended December 31, 2022 compared to $125.8 million, or $6.10 per share, for the three months ended December 31, 2021, an increase of 12.6%. Adjusted net income1 of $711.0 million, or $34.68 per share, for the year ended December 31, 2022 compared to $362.3 million, or $17.60 per share, for the year ended December 31, 2021, an increase of 96.2%. • Cash and cash equivalents amounted to $267.7 million as of December 31, 2022. • Total liquidity, including undrawn available commitments under our Revolving Credit Facility amounted to $650.2 million as of December 31, 2022. • Operating revenues of $252.5 million for the three months ended December 31, 2022 compared to $215.0 million for the three months ended December 31, 2021, an increase of 17.4%. Operating revenues of $993.3 million for the year ended December 31, 2022 compared to $689.5 million for the year ended December 31, 2021, an increase of 44.1%. • Adjusted EBITDA 1 of $176.4 million for the three months ended December 31, 2022 compared to $159.2 million for the three months ended December 31, 2021, an increase of 10.8%. Adjusted EBITDA 1 of $851.2 million for the year ended December 31, 2022 compared to $508.8 million for the year ended December 31, 2021, an increase of 67.3%. • Total contracted cash operating revenues were $2.1 billion as of December 31, 2022 and remaining average contracted charter duration was 3.4 years, weighted by aggregate contracted charter hire. • Contracted operating days charter coverage currently stands at 92.6% for 2023 and 63.3% for 2024. • During 2022, we made early prepayment of $909.1 million of bank debt, lease and bond indebtedness and realized a $4.4 million gain associated with this debt extinguishment. Additionally, during 2022 we drew down $185.25 million from new credit facilities while we also entered into a $382.5 million Revolving Credit Facility that is available and undrawn as of December 31, 2022. • As a result of the above, as of December 31, 2022, Net Debt 2 was $243.3 million, Net Debt / LTM Adjusted EBITDA was 0.29x, while 42 of our vessels are debt-free currently. • Danaos has declared a dividend of $0.75 per share of common stock for the fourth quarter of 2022, which is payable on March 14, 2023 to stockholders of record as of February 28, 2023.

(1) Adjusted net income, adjusted earnings per share and adjusted EBITDA are non-GAAP measures. Refer to the reconciliation of net income to adjusted net income and net income to adjusted EBITDA provided below. (2) Net Debt is defined as total debt gross of deferred finance costs less cash and cash equivalents. Danaos' CEO Dr. John Coustas commented: "This past year marked the peak of the container market, and the exceptionally strong market conditions we saw over the last two years are behind us. The decline in box rates to pre-pandemic levels across all sailing routes, foreshadows difficult times ahead. The liner companies are projecting 2023 earnings materially lower when compared with 2022, and we are still waiting to see the full effect of the looming recession. Charter rates have fallen significantly but remain higher than pre-pandemic levels. However, charter durations rarely exceed 12 months. Fortunately, we are insulated from current market conditions as 93% of our available days are already contracted for 2023, providing us with excellent visibility for the year ahead. Given our limited near-term downside risk and our minimal debt obligations, we have ample firepower to opportunistically take advantage of the forthcoming downturn. We are closely following the developments in the liner space, and the dismantling of the 2M alliance will definitely be positive for the non-operating owners as there will be less efficiency in the networks. Additionally, the effects of decarbonization have not been factored in the forecasts for effective fleet supply reduction through the anticipated reduction in service speeds. Liner companies are just now beginning to study the Carbon Intensity Indicator, or CII, of their owned and chartered vessels, and due to widespread criticism of the current structure of the index and the expectation that it will most likely be modified, no concrete action is being taken to redesign networks with a view to conform to the index. Danaos is actively investigating various decarbonization strategies for our existing fleet and is actively involved in the optimization of the six environmentally friendly newbuildings that are being delivered to us next year. We remain committed to our strategy of accretive growth and delivering superior results for our shareholders." Full report About Danaos Corporation Danaos Corporation is one of the largest independent owners of modern, large-size containerships. Our current fleet of 68 containerships aggregating 421,293 TEUs and 6 under construction containerships aggregating 46,200 TEUs ranks Danaos among the largest containership charter owners in the world based on total TEU capacity. Our fleet is chartered to many of the world's largest liner companies on fixed-rate charters. Our long track record of success is predicated on our efficient and rigorous operational standards and environmental controls. Danaos Corporation's shares trade on the New York Stock Exchange under the symbol "DAC". Danaos Corporation press release

|