|

Hamilton, Bermuda - August 10, 2022

DHT Holdings, Inc. (NYSE: DHT) ("DHT" or the "Company") today announced:

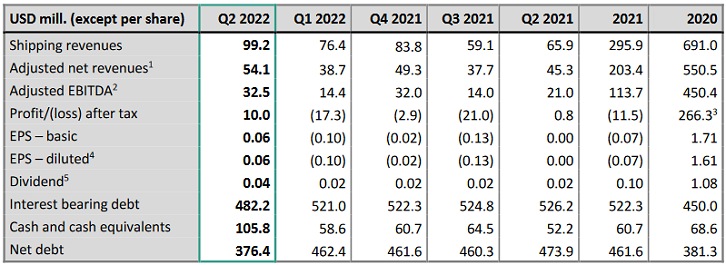

Financial Highlights

Quarterly Highlights:

|

|

• Adjusted EBITDA for the second quarter of 2022 was $32.5 million. Net profit for the quarter was $10.0 million which equates to $0.06 per basic share.

• In May 2022, the Company entered into agreements to sell DHT Hawk, built 2007, and DHT Falcon, built 2006, for $40 million and $38 million, respectively. The vessels were both delivered during the second quarter of 2022 and the sales generated a combined gain of $12.7 million. The Company repaid the outstanding debt of $13.3 million combined on the two vessels.

• In June 2022, the Company prepaid $23.1 million under the Nordea Credit Facility. The voluntary prepayment was made under the revolving credit facility tranche and may be re-borrowed.

• In the second quarter of 2022, the Company purchased 2,826,771 of its own shares in the open market for an aggregate consideration of $15.9 million, at an average price of $5.6256. All shares were retired upon receipt.

• For the second quarter of 2022, the Company declared a cash dividend of $0.04 per share of outstanding common stock, payable on August 30, 2022, to shareholders of record as of August 23, 2022. This marks the 50th consecutive quarterly cash dividend. The shares will trade ex-dividend from August 22, 2022.

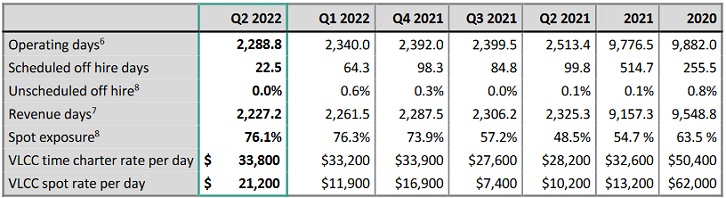

Operational Highlights

|

|

The near-term market outlook is showing signs of improvement although still impacted by geopolitical events. The Covid-19 situation in China and its lockdowns is slowing down the demand recovery. The geopolitical events challenging the energy security situation are impacting the price and availability of oil; with the oil price curve in backwardation. Near term, this stimulates consumption of inventories as opposed to building inventories. OPEC is forecasting a meaningful increase in global oil demand next year and states it needs to deliver a significant production increase to meet such forecasted demand. We would expect such a scenario to be positive for demand for oil transportation.

The trade disruptions resulting from the current geopolitical conflicts have increased transportation distances and, given various physical restrictions for larger sized vessels, have primarily been supportive of freight routes for smaller sized vessels. These trade disruptions have also changed the sourcing of refined oil products, supporting freight rates for product tankers. As we find it hard to assume a dislocation between clean and dirty tankers can persist for a prolonged period of time, we think it is reasonable to expect a market adjustment to occur. As this happens at a time of low inventories of crude oil, barring macroeconomic setbacks, we think it is logical to expect demand for feedstock and thus crude oil transportation to improve as a result of the current situation.

The dynamics of the oil market could set crude oil transportation up for a rewarding period of strengthening freight rates. The world fleet is rapidly aging at a time when ordering of new ships is very limited. It is not unthinkable for the fleet to shrink at a time when demand for transportation is expected to recover, likely creating a rewarding environment for large tankers. All things considered, we are convinced of the merits of our strategy with reduced financial leverage and low cash break-even levels to protect the downside without giving away the upside. We believe our company is well structured for cyclical markets and that our strategy will reward our shareholders.

As of June 30, 2022, DHT had a fleet of 24 VLCCs, with a total dwt of 7,453,519. For more details on the fleet, please refer to the web site: https://www.dhtankers.com/fleetlist/

Subsequent Event Highlights

• In July 2022, the Company entered into a five-year time-charter for DHT Osprey at $37,000 per day, with charterer's option to extend two additional years, at $40,000 per day and $45,000 per day, respectively. The vessel is expected to deliver into the contract in August.

• In July 2022, the Company agreed to a $37.5 million refinancing of the DHT Tiger with Credit Agricole. The new facility has a tenor of 6 years and an amortization profile of 20 years. It will bear an interest rate of Secured Overnight Financing Rate (SOFR) plus a margin of 2.05%, which includes the historical Credit Adjustment Spread (CAS) of 26 basis points. As such, the cost of the facility would compare to a Libor equivalent margin of 179 basis points, representing a reduction in the Company's borrowing cost.

• The Company has committed $25 million to retrofit an additional 8 vessels with scrubbers. The vessels are DHT Colt, DHT Jaguar, DHT Leopard, DHT Lion, DHT Panther, DHT Puma, DHT Stallion and DHT Tiger. All the vessels are of Eco-design and built between 2015 and 2018. The Company expects to commence the retrofit program in Q4 2022 and complete during Q1 2023. The combination of lower cost and the current higher fuel spreads makes this a compelling investment. The investment will be funded with liquidity at hand hence no new debt will be issued. Following the completion of this project, the Company will have 23 vessels fitted with scrubbers.

• So far in the third quarter of 2022, the Company has purchased 1,499,608 of its own shares in the open market for an aggregate consideration of $8.8 million, at an average price of $5.8721. All shares have been retired upon receipt. As of the date of this report, the Company has 162,653,339 shares outstanding.

Outlook

• Thus far in the third quarter of 2022, 68% of the available VLCC days have been booked at an average rate of $23,600 per day on a discharge-to-discharge basis (not including any potential profit splits on time charters).

1. Shipping revenues net of voyage expenses.

2. Shipping revenues net of voyage expenses, other revenues, vessel operating expenses and general and administrative expenses.

3. 2020 includes impairment charge of $12.6 million.

4. Diluted shares include the dilutive effect of the convertible senior notes and restricted shares granted to management and members of the board of directors.

5. Per common share.

6. Operating days are the aggregate number of calendar days in the period in which the vessels are owned by the Company or chartered by the Company.

7. Revenue days are the aggregate number of calendar days in the period in which the vessels are owned by the Company or chartered by the Company less days on which a vessel is off hire.

8. As % of total operating days in period.

Second Quarter 2022 Financials

The Company reported shipping revenues for the second quarter of 2022 of $99.2 million compared to shipping revenues of $65.9 million in the second quarter of 2021. The increase from the 2021 period to the 2022 period includes $36.1 million attributable to higher tanker rates partially offset by $2.8 million attributable to a decrease in total revenue days.

Other revenues for the second quarter of 2022 were $0.7 million and mainly relates to technical management services provided.

Voyage expenses for the second quarter of 2022 were $45.2 million, compared to voyage expenses of $20.7 million in the second quarter of 2021. The increase was due to more vessels in the spot market and higher bunker prices, resulting in a $22.0 million increase in bunker expenses and a $2.4 million increase in port cost.

Vessel operating expenses for the second quarter of 2022 were $18.0 million compared to $19.6 million in the second quarter of 2021. The decrease was mainly due to fewer operating days in Q2 2022 compared to Q2 2021 with 2,289 operating days in Q2 2022 compared to 2,513 operating days in Q2 2021.

Depreciation and amortization, including depreciation of capitalized survey expenses, was $32.3 million for the second quarter of 2022, compared to $32.2 million in the second quarter of 2021. The change was due to increased depreciation related to scrubbers of $1.4 million, partially offset by a decrease in depreciation related to vessels and docking of $1.2 million.

The Company recorded a gain of $12.7 million for the second quarter of 2022 related to the sale of DHT Hawk and DHT Falcon compared to a gain of $13.6 million for the second quarter of 2021 related to the sale of DHT Raven and DHT Lake.

General and administrative expense ("G&A") for the second quarter of 2022 was $4.2 million, consisting of $3.3 million cash and $0.9 million non-cash charge, compared to $4.7 million in the second quarter of 2021, consisting of $3.8 million cash and $0.9 million non-cash charge. Non-cash G&A includes accrual for social security tax.

Net financial expenses for the second quarter of 2022 were $2.8 million compared to $1.7 million in the second quarter of 2021. The increase was mainly due to a $3 million gain related to debt modification in the second quarter of 2021, partially offset by a non-cash gain of $4.3 million related to interest rate derivatives in the second quarter of 2022 compared to a non-cash gain of $2.2 million in the second quarter of 2021.

As a result of the foregoing, the Company had a net profit in the second quarter of 2022 of $10.0 million, or income of $0.06 per basic share and $0.06 per diluted share, compared to a net profit in the second quarter of 2021 of $0.8 million, or income of $0.00 per basic share and $0.00 per diluted share. The increase from the 2021 period to the 2022 period was mainly due to higher tanker rates.

Net cash provided by operating activities for the second quarter of 2022 was $26.3 million compared to $33.9 million for the second quarter of 2021. The decrease was due to a $18.6 million change in operating assets and liabilities, partially offset by a profit of $10.0 million in the second quarter of 2022 compared to profit of $0.8 million in the second quarter of 2021 and a $1.8 million increase in non-cash items included in net income.

Net cash provided by investing activities was $79.9 million in the second quarter of 2022 and comprised $76.2 million related to sale of vessels and $8.3 million related to acquisition of subsidiary, net of cash paid, partially offset by $4.5 million related to investment in vessels. Net cash provided by investing activities was $40.1 million in the second quarter of 2021 comprising $57.5 million related to sale of vessels, partially offset by $17.3 million related to investment in vessels.

Net cash used in financing activities for the second quarter of 2022 was $59.1 million comprised of $23.1 million related to prepayment of long-term debt, $15.9 million related to purchase of treasury shares, $13.3 million related to repayment of long-term debt in connection with sale of vessels, $3.3 million related to cash dividend paid and $3.1 million related to scheduled repayment of long-term debt. Net cash used in financing activities for the second quarter of 2021 was $75.8 million comprised of $175.9 million related to repayment of long-term debt in connection with refinancing, $93.4 million related to prepayment of long-term debt, $22.5 million related to purchase of treasury shares, $6.8 million related to cash dividend paid, $6.1 million related to repayment of long-term debt in connection with sale of vessel and $1.9 million related to scheduled repayment of long-term debt, partially offset by $230.9 million related to issuance of long-term debt.

As of June 30, 2022, the cash balance was $105.8 million, compared to $60.7 million as of December 31, 2021. The Company monitors its covenant compliance on an ongoing basis. As of June 30, 2022, the Company was in compliance with its financial covenants.

As of June 30, 2022, the Company had 164,152,947 shares of common stock outstanding compared to 166,126,770 shares as of December 31, 2021.

The Company declared a cash dividend of $0.04 per common share for the second quarter of 2022 payable on August 30, 2022, for shareholders of record as of August 23, 2022.

First Half 2022 Financials

The Company reported shipping revenues for the first half of 2022 of $175.6 million compared to $152.9 million in the first half of 2021. The increase from the 2021 period to the 2022 period includes $25.2 million attributable to higher tanker rates partially offset by $2.5 million attributable to decreased total revenue days.

Other revenues for the first half of 2022 were $0.7 million and mainly relates to technical management services provided.

Voyage expenses for the first half of 2022 were $82.8 million compared to voyage expenses of $36.4 million in the first half of 2021. The increase was due to more vessels in the spot market and higher bunker prices, resulting in a $43.5 million increase in bunker expenses and a $4.9 million increase in port expenses.

Vessel operating expenses for the first half of 2022 were $36.3 million, compared to $38.6 million in the first half of 2021. The decrease was mainly due to fewer operating days in the first half of 2022 compared to the first half of 2021 with 4,629 operating days in the first half of 2022 compared to 4,985 operating days in the first half of 2021.

Depreciation and amortization, including depreciation of capitalized survey expenses, was $65.4 million for the first half of 2022, compared to $64.2 million in the first half of 2021. The increase was mainly due to increased depreciation related to scrubbers of $3.9 million, partially offset by a decrease in depreciation related to vessels and docking of $2.3 million.

The Company recorded a gain of $12.7 million for the first half of 2022 related to the sale of DHT Hawk and DHT Falcon compared to a gain of $13.6 million for the first half of 2021 related to the sale of DHT Raven and DHT Lake.

G&A for the first half of 2022 was $10.3 million, consisting of $7.3 million cash and $2.9 million non-cash charge, compared to $10.2 million, consisting of $7.4 million cash and $2.8 million non-cash charge for the first half of 2021.

Net financial expenses for the first half of 2022 were $1.3 million, compared to $4.6 million in the first half of 2021. The decrease was due to a non-cash gain of $12.1 million related to interest rate derivatives in the first half of 2022 compared to a non-cash gain of $5.7 million in the first half of 2021, partially offset by a $3.0 million gain related to the debt modification recorded in the second quarter of 2021.

The Company had net loss for the first half of 2022 of $7.3 million, or loss of $0.05 per basic share and $0.05 per diluted share compared to net profit of $12.4 million, or income of $0.07 per basic share and $0.07 per diluted share in the first half of 2021. The difference between the two periods mainly reflects higher tanker rates.

Net cash provided by operating activities for the first half of 2022 was $32.0 million compared to $44.8 million for the first half of 2021. The decrease was mainly due to net loss of $7.3 million in the first half of 2022 compared to net gain of $12.4 million in the first half of 2021, $1.2 million decrease in non-cash items included in net income, partially offset by $8.1 million related to changes in operating assets and liabilities.

Net cash provided by investing activities for the first half of 2022 was $77.6 million comprising $76.2 million related to sale of vessels and $8.3 million related to acquisition of subsidiary, net of cash paid, partially offset by $6.9 million related to investment in vessels. Net cash used in investing activities for the first half of 2021 was $101.0 million comprising $158.5 million related to investment in vessels, partially offset by $57.5 million related to sale of vessels.

Net cash used in financing activities for the first half of 2022 was $64.5 million comprising $23.1 million related to prepayment of long-term debt, $15.9 million related to purchase of treasury shares, $13.3 million related to repayment of long-term debt in connection with sale of vessels, $6.7 million related to cash dividends paid and $5.1 million related to scheduled repayment of long-term debt. Net cash provided by financing activities for the first half of 2021 was $39.8 million comprising $355.9 million related to issuance of long-term debt, partially offset by $175.9 million related to repayment of long-term debt in connection with refinancing, $93.4 million related to prepayment of long-term debt, $22.5 million related to purchase of treasury shares, $15.4 million related to cash dividends paid, $6.1 million related to repayment of long-term debt in connection with sale of vessel and $2.6 million related to scheduled repayment of long-term debt.

As of June 30, 2022, our cash balance was $105.8 million, compared to $60.7 million as of December 31, 2021.

As of June 30, 2022, the Company had 164,152,947 shares of our common stock outstanding compared to 166,126,770 as of December 31,

Full report

About Dht Holdings, Inc.

DHT is an independent crude oil tanker company. Our fleet trades internationally and consists of crude oil tankers in the VLCC segment. We operate through our integrated management companies in Monaco, Norway, and Singapore. You may recognize us by our renowned business approach as an experienced organization with focus on first rate operations and customer service; our quality ships; our prudent capital structure that promotes staying power through the business cycles; our combination of market exposure and fixed income contracts for our fleet; our counter cyclical philosophy with respect to investments, employment of our fleet, and capital allocation; and our transparent corporate structure maintaining a high level of integrity and good governance. For further information please visit http://www.dhtankers.com.

DHT Holdings, Inc. press release