|

Hamilton, Bermuda - November 7, 2022

DHT Holdings, Inc. (NYSE: DHT) ("DHT" or the "Company") today announced:

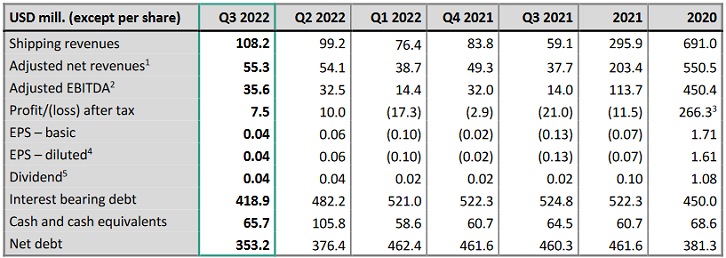

Financial Highlights

Quarterly Highlights

|

|

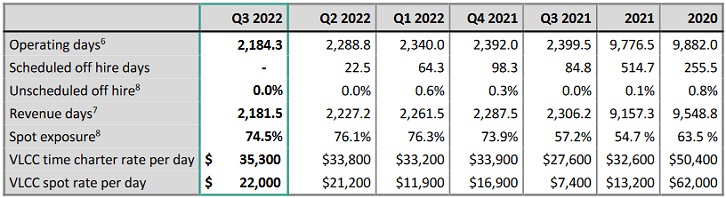

• In the third quarter of 2022, the Company achieved combined time charter equivalent earnings of $25,400 per day, comprised of $35,300 per day for the Company's VLCCs on time-charter and $22,000 per day for the Company's VLCCs operating in the spot market. The result for the Company's VLCCs operating in the spot market, measured on a discharge-to-discharge basis, was $27,100 per day for the third quarter of 2022.

• Adjusted EBITDA for the third quarter of 2022 was $35.6 million. Net profit for the quarter was $7.5 million which equates to $0.04 per basic share.

• In September, the Company entered into a five-year time-charter contract for DHT Puma or substitute, at $38,000 per day, with charterer's option to extend two additional years, at $41,000 per day and $45,000 per day, respectively. The vessel is expected to deliver into the contract after the installation of an Exhaust Gas Cleaning System in the first quarter of 2023.

• In August 2022, the Company entered into an agreement to sell DHT Edelweiss, a 2008 built VLCC, for $37.0 million. The vessel was not fitted with an Exhaust Gas Cleaning System and was due for its 3rd Special Survey and installation of a Ballast Water Treatment System in the first quarter of 2023. The vessel was delivered to its new owner during the third quarter of 2022 and the sale generated a gain of $6.8 million. The Company repaid the outstanding debt of $12.2 million in connection with the sale.

• In September 2022, the Company announced a new dividend policy with 100% of net income being returned to shareholders in the form of quarterly cash dividends. The new policy will be implemented from the third quarter of 2022.

• In September 2022, the Company prepaid $50.0 million under the Nordea Credit Facility. The voluntary prepayment was made under the revolving credit facility tranche and may be re-borrowed.

• In the third quarter of 2022, the Company purchased 1,499,608 of its own shares in the open market for an aggregate consideration of $8.8 million, at an average price of $5.87 per share. All shares were retired upon receipt.

• For the third quarter of 2022, the Company declared a cash dividend of $0.04 per share of outstanding common stock, payable on November 29, 2022, to shareholders of record as of November 22, 2022. This marks the 51st consecutive quarterly cash dividend. The shares will trade ex-dividend from November 21, 2022.

Operational Highlights

Covid-19 restrictions related to our seafarers and the ability to change crews are easing, save for restrictions in China. Some customers have implemented their own restrictions adding complexities to managing crew changes. We continue to do everything reasonably possible to facilitate safe and regular crew changes. As of the date of this report, all our seafarers are fully vaccinated at the time of joining a vessel, as is the majority of our onboard sailing crew.

The market recovery has commenced with more cargo in the market when compared to last year and the first half of this year. In addition, trade disruptions are resulting in increased transportation distances, reducing the productivity of the global tanker fleet hence driving rates upwards. The Covid-19 lockdown in China still prevails but a policy change would likely support a stronger recovery. The geopolitical events challenging the energy security situation, in combination with macro-economic issues, are impacting the oil market, the oil price curve and volatility. OPEC+ has introduced reductions in production quotas but actual production levels will likely only be partly impacted. The leading agencies are forecasting increased global oil demand next year. As incremental supply is mainly seaborne, combined with increasing transportation distances, this should continue to be positive for demand for oil transportation.

The world fleet is aging at a time when ordering of new ships is very limited. One could envisage the fleet to shrink at a time when demand for transportation is recovering, creating a rewarding environment for large tankers. All things considered, we are convinced of the merits of our strategy with reduced financial leverage and low cash break-even levels to protect the downside without giving away the upside. We believe our company is well structured for cyclical markets and that our strategy will reward our shareholders.

As of September 30, 2022, DHT had a fleet of 23 VLCCs, with a total dwt of 7,152,498. For more details on the fleet, please refer to the web site: www.dhtankers.com/fleetlist

Full report

About DHT Holdings, Inc.

DHT is an independent crude oil tanker company. Our fleet trades internationally and consists of crude oil tankers in the VLCC segment. We operate through our integrated management companies in Monaco, Norway and Singapore.

You may recognize us by our renowned business approach as an experienced organization with focus on first rate operations and customer service; our quality ships; our prudent capital structure that promotes staying power through the business cycles; our combination of market exposure and fixed income contracts for our fleet; our counter cyclical philosophy with respect to investments, employment of our fleet, and capital allocation; and our transparent corporate structure maintaining a high level of integrity and good governance. For further information please visit www.dhtankers.com.

DHT Holdings, Inc. press release