|

Hamilton, Bermuda - February 8, 2023

DHT Holdings, Inc. (NYSE:DHT) ("DHT" or the "Company") today announced its results for the quarter ended December 31, 2022.

FINANCIAL HIGHLIGHTS:

QUARTERLY HIGHLIGHTS:

|

|

• Adjusted EBITDA for the fourth quarter of 2022 was $95.4 million. Net profit for the quarter was $61.8 million which equates to $0.38 per basic share.

• In December 2022, the Company prepaid $23.7 million under the Nordea Credit Facility. The voluntary prepayment was made for all regular installments for 2023.

• In November 2022, the Company entered into agreement for a $37.5 million refinancing with Credit Agricole. The new loan will bear interest at a rate equal to Secured Overnight Financing Rate (SOFR) + 2.05%, including the historical Credit Adjustment Spread (CAS) of 26 basis points. The cost of the facility compares to a LIBOR equivalent margin of 179 basis points and the facility is repayable in quarterly installments of $0.6 million with final maturity in December 2028.

• For the fourth quarter of 2022, the Company declared a cash dividend of $0.38 per share of outstanding common stock, payable on February 24, 2023, to shareholders of record as of February 17, 2023. This marks the 52nd consecutive quarterly cash dividend. The shares will trade ex-dividend from February 16, 2023.

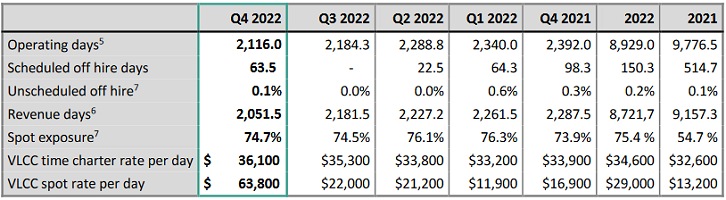

OPERATIONAL HIGHLIGHTS:

|

|

The market recovery is continuing, albeit, with a recent dip in freight rates. The market has however demonstrated resistance levels and stayed profitable for the Company. Leading agencies have lifted global oil demand forecasts and revised non-OPEC supply upwards, both supportive of the freight market in which we operate. The revised demand forecasts are in particular related to China and the opening up of its society, expected to drive increased refinery runs and consumption of oil. This is underscored by recent announcements of China's increased import quotas for crude oil.

The VLCC orderbook and the number of remaining deliveries of new ships is being reduced quickly, with only 2.4% of total fleet yet to be delivered. This stands in stark contrast to 30.2% and 14.1% of the fleet now being older that 15- and 20- years, respectively. Most ships older than 20 years are engaged in trades either partly or fully sanctioned. Although these ships serve a purpose in the greater market, we find it hard to believe these ships will stay in business over time, or ever return to the compliant market, hence this phenomenon could be viewed as the "new scrapping" in due course. We maintain our expectation of the fleet to start shrinking over the next couple of years.

There are still macro-economic challenges on the horizon, but recent data and reports increasingly suggest that a constructive market view can be applied going forward.

We are convinced of the merits of our strategy and continue to focus on running our business as efficiently as we can with strong revenue generation for our assets, a competitive cost base and low financial leverage. With this backdrop, we believe our policy of returning 100% of net income as quarterly cash dividends will reward our shareholders.

As of December 31, 2022, DHT had a fleet of 23 VLCCs, with a total dwt of 7,152,498. For more details on the fleet, please refer to the web site: https://www.dhtankers.com/fleetlist/

SUBSEQUENT EVENT HIGHLIGHTS:

• In January 2023, the Company agreed to a $405 million secured credit facility, including a $100 million uncommitted incremental facility. ING and Nordea will act as joint coordinators and bookrunners with ING, Nordea, ABN Amro, Credit Agricole, Danish Ship Finance and SEB as mandated lead arrangers. The new facility will bear interest at a rate equal to Secured Overnight Financing Rate (SOFR) plus a margin of 1.90%, including the historical Credit Adjustment Spread (CAS) of 26 basis points. The cost of the facility compares to a LIBOR equivalent margin of 164 basis points, representing a reduction in the Company's borrowing cost. The new facility will refinance the outstanding amount on the current ABN Amro credit facility and be secured by 10 of the Company's VLCCs. The new facility is in line with the "DHT-style financing" including a six-year tenor and a 20-year repayment profile.

• In January 2023, the Company terminated 7 interest rate swaps with maturity in the second and third quarter of 2023. The Company received $3.3 million in connection with the terminations.

• So far in the first quarter of 2023, the Company has completed the installation of exhaust gas cleaning systems for two vessels. There are currently two additional vessels in the shipyard, with four remaining vessels planned to enter the shipyard in the first or second quarter of 2023.

Full report

About DHT Holdings, Inc.

DHT is an independent crude oil tanker company. Our fleet trades internationally and consists of crude oil tankers in the VLCC segment. We operate through our integrated management companies in Monaco, Norway and Singapore. You may recognize us by our renowned business approach as an experienced organization with focus on first rate operations and customer service; our quality ships; our prudent capital structure that promotes staying power through the business cycles; our combination of market exposure and fixed income contracts for our fleet; our counter cyclical philosophy with respect to investments, employment of our fleet, and capital allocation; and our transparent corporate structure maintaining a high level of integrity and good governance. For further information please visit: http://www.dhtankers.com.

DHT Holdings, Inc. press release