|

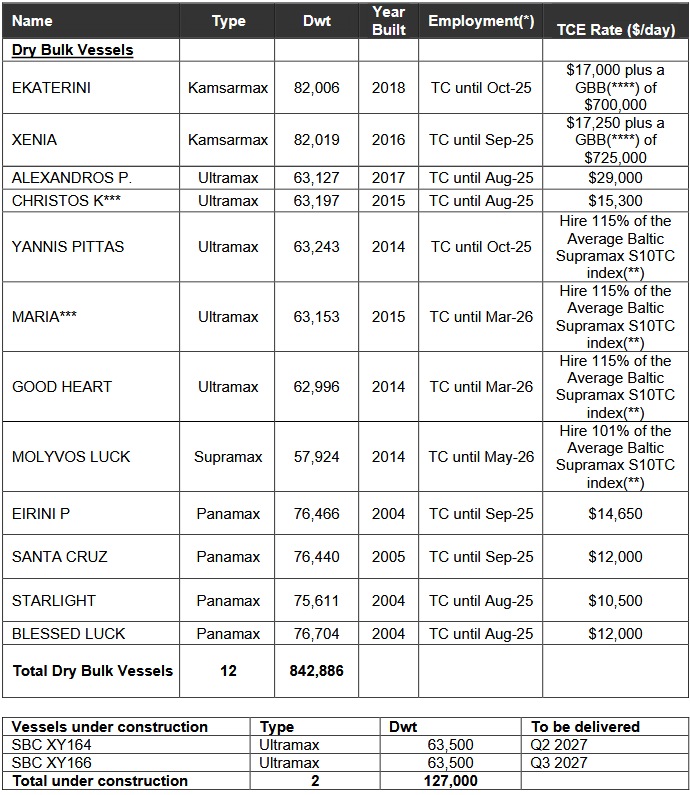

Athens, Greece - August 11, 2025 EuroDry Ltd. (NASDAQ: EDRY, the "Company" or "EuroDry"), an owner and operator of drybulk vessels and provider of seaborne transportation for drybulk cargoes, announced today its results for the three- and six-month periods ended June 30, 2025. Second Quarter 2025 Highlights: • Total net revenues for the quarter of $11.3 million. • Net loss attributable to controlling shareholders, of $3.1 million or $1.12 loss per share basic and diluted. • Adjusted net loss1 attributable to controlling shareholders for the quarter of $3.0 million or $1.10 loss per share basic and diluted. • Adjusted EBITDA1 for the quarter was $1.9 million. • An average of 12.0 vessels were owned and operated during the second quarter of 2025 earning an average time charter equivalent rate of $10,428 per day. • To date, about $5.3 million has been used to repurchase 334,674 shares of the Company, under our share repurchase plan of up to $10 million, announced in August 2022. The Board approved the continuation of the Program for a further year in August 2024 and 2025, respectively, and will review it again after a period of twelve months. • The Company also will publish its 2024 Sustainability/ESG Report tomorrow, August 12, 2025, which will be available at its website: www.eurodry.gr/company/sustainability.html First Half 2025 Highlights: • Total net revenues of $20.5 million. • Net loss attributable to controlling shareholders was $6.8 million or $2.47 loss per share basic and diluted. • Adjusted net loss1 attributable to controlling shareholders for the period was $8.7 million or $3.17 adjusted loss per share basic and diluted1. • Adjusted EBITDA1 of $0.9 million. • An average of 12.4 vessels were owned and operated during the first half of 2025 earning an average time charter equivalent rate of $8,761 per day. Aristides Pittas, Chairman and CEO of EuroDry commented: "During the second quarter of 2025 the drybulk market recovered a bit but the rebound was not sufficient to return the company to profitability. In July 2025, the market remained strong approaching the breakeven rate level of our fleet before giving up some of the gains in early August, a month, though, which is traditionally seasonally weak. If the present level of rates is maintained during August and, more so, if it improves, as usually happens during September, we would expect to have a better third quarter in terms of financial results as all our vessels are employed in short-term charters or linked to market index levels. The near-term outlook is dependent on the geopolitical and overall macroeconomic developments with the effect of the US imposed tariffs and the countermeasures taken by other countries being at the forefront of the uncertainty on the demand side. In addition, the recent attacks on two bulk carriers in Red Sea only increase the uncertainty and, generally, help higher demand for vessels as even fewer owners and operators would be crossing the area following the attacks. As discussed in previous presentations of our chartering strategy, we have kept our vessels on short term charters when rates were low and at non-profitable levels. However, if the markets improve further, we will consider entering into year-long charters (physical or through FFA's) for a portion of our fleet to lock-in positive cash flow. At the same time, we are looking at renewal opportunities of our elder vessels and financing options that could allow us to expand our fleet in accretive ways." Tasos Aslidis, Chief Financial Officer of EuroDry commented: "The net revenues of the second quarter of 2025 were weaker compared to the second quarter of 2024 as a result of the lower time charter equivalent rates our vessels earned, and the decreased average number of vessels operated during the second quarter of 2025 compared to the same period of 2024. The time charter equivalent rates for the second quarter of 2025 were lower by 27.7% on average compared to the time charter equivalent rates our vessels earned in the second quarter of 2024. Daily vessel operating expenses, including management fees, but excluding dry-docking costs, averaged $6,785 per vessel per day during the second quarter of 2025 as compared to $6,396 per vessel per day for the same quarter of last year, and $6,685 per vessel per day for the first half of 2025 as compared to $6,289 per vessel per day for the same period of 2024. The main reason for this increase is the adjustment for inflation in the daily vessel management fee, effective from January 1, 2025, increasing it from 810 Euros to 840 Euros, and the unfavorable movement of the euro/dollar exchange rate during the period. General and administrative expenses averaged $754 per vessel per day during the second quarter of 2025 as compared to $666 per vessel per day for the same quarter of last year, and $734 per vessel per day for the first half of 2025 as compared to $675 per vessel per day for the same period of 2024. This increase is explained by the allocation of expenses of approximately the same levels in the respective three-month and six-month periods, to a decreased number of vessels in the three months and six months ended June 30, 2025. Adjusted EBITDA during the second quarter of 2025 was $1.9 million compared to $5.0 million in the second quarter of last year. As of June 30, 2025, our outstanding debt (excluding the unamortized loan fees) was $102.1 million, while unrestricted and restricted cash was $11.4 million. As of the same date, our scheduled debt repayments including balloon payments over the next 12 months amounted to about $12.7 million." Second Quarter 2025 Results: For the second quarter of 2025, the Company reported total net revenues of $11.3 million representing a 35.3% decrease over total net revenues of $17.4 million during the second quarter of 2024 which was the result of the lower time charter rates our vessels earned, and the decreased average number of vessels operated during the second quarter of 2025 compared to the same period of 2024. On average, 12.0 vessels were owned and operated during the second quarter of 2025 earning an average time charter equivalent rate of $10,428 per day compared to 13.0 vessels in the same period of 2024 earning on average $14,427 per day. For the second quarter of 2025, voyage expenses, net amounted to $0.8 million and mainly relate to vessels repositioning between charters and expenses during operational off-hire time, as compared to $2.2 million in the same period of 2024. Vessel operating expenses decreased to $6.3 million for the second quarter of 2025 from $6.6 million in the same period of 2024. The decrease is mainly attributable to the decreased number of vessels operating in the second quarter of 2025 compared to the corresponding period in 2024. Depreciation expense for the second quarter of 2025 was $3.2 million compared to $3.5 million for the same period of 2024 as a result of the lower number of vessels owned and operated in the second quarter of 2025. Related party management fees for the period were $1.1 million compared to $1.0 million for the same period of 2024, due to the adjustment for inflation in the daily vessel management fee, effective from January 1, 2025, increasing it from 810 Euros to 840 Euros and the unfavorable movement of the euro/dollar exchange rate, partly offset by the lower number of vessels owned and operated in the respective period. General and administrative expenses for the second quarter of 2025 were $0.8 million remaining at the same level as compared to the second quarter of 2024. During the second quarter of 2025, one vessel completed its intermediate survey in water and another one commenced her special survey with dry-dock in order to complete it during the third quarter of 2025, for a total cost of $0.4 million. During the second quarter of 2024, there was one vessel that completed its special survey and another two commenced their special survey with dry-dock in order to complete it during the third quarter of 2024, for a total cost of $1.9 million. Interest and other financing costs for the second quarter of 2025 amounted to $1.7 million compared to $2.0 million for the same period of 2024. Interest expense during the second quarter of 2025 was lower mainly due to the decreased benchmark rates of our loans, partly offset by the increased average debt during the second quarter of 2025, as compared to the same period of last year. For the three months ended June 30, 2025, the Company recognized a $0.06 million unrealized loss and a $0.03 million realized gain on one interest rate swap. The results for the second quarter of 2024 include an unrealized gain of $0.04 million and a realized gain of $0.05 million on an interest rate swap contract. The Company reported a net loss for the period of $3.1 million and a net loss attributable to controlling shareholders of $3.07 million, as compared to a net loss of $0.3 million and a net loss attributable to controlling shareholders of $0.4 million for the same period of 2024. The net loss attributable to the non-controlling interest of $0.04 million in the second quarter of 2025 represents the loss attributable to the 39% ownership of the entities owning the M/V Christos K and M/V Maria represented by NRP Project Finance AS ("NRP investors") (the "Partnership"). Adjusted EBITDA for the second quarter of 2025 was $1.9 million compared to $5.0 million achieved during the second quarter of 2024. Basic and diluted loss per share attributable to controlling shareholders for the second quarter of 2025 was $1.12 calculated on 2,737,297 basic and diluted weighted average number of shares outstanding, compared to loss per share of $0.15 calculated on 2,710,413 basic and diluted weighted average number of shares outstanding for the second quarter of 2024. Excluding the effect on the net loss attributable to controlling shareholders for the quarter of the unrealized (gain) / loss on derivatives, the adjusted loss attributable to controlling shareholders for the quarter ended June 30, 2025 would have been $1.10 per share basic and diluted, compared to adjusted loss of $0.17 per share basic and diluted, for the quarter ended June 30, 2024. Usually, security analysts do not include the above item in their published estimates of earnings per share. First Half 2025 Results: For the first half of 2025, the Company reported total net revenues of $20.5 million representing a 35.7% decrease over total net revenues of $31.9 million during the first half of 2024, which was the result of the lower time charter rates our vessels earned, and the decreased average numbers of vessels operated during the first half of 2025 compared to the same period of 2024. On average, 12.4 vessels were owned and operated during the first half of 2025 earning an average time charter equivalent rate of $8,761 per day compared to 13.0 vessels in the same period of 2024 earning on average $13,452 per day. For the first half of 2025, Voyage expenses, net, were $2.5 million and mainly relate to vessels repositioning between charters and expenses during operational off-hire time. For the same period of 2024, voyage expenses, net were $3.7 million and mainly relate to vessels repositioning between charters and expenses during operational off-hire time. Vessel operating expenses were $12.8 million for the first half of 2025, remaining at the same level as compared to $12.8 million for the first half of 2024. Depreciation expense for the first half of 2025 was $6.4 million compared to $6.9 million during the same period of 2024, mainly due to the lower number of vessels operating in the first half of 2025 compared to the same period of 2024. Related party management fees for the first half of 2025 were slightly increased to $2.2 million from $2.1 million for the same period of 2024 due to the adjustment for inflation in the daily vessel management fee, effective from January 1, 2025, increasing it from 810 Euros to 840 Euros, and the unfavorable movement of the euro/dollar exchange rate during the period, partly offset by the lower average number of vessels owned and operated in the six month period of 2025. General and administrative expenses for the first half of 2025, remained at the same level of $1.6 million as compared to the corresponding period in 2024. During the first half of 2025 one vessel completed its intermediate survey in water and another one commenced her special survey with dry-dock in order to complete it during the third quarter of 2025, for a total cost of $0.4 million. During the first half of 2024 three of our vessels completed their special survey with drydocking and another two commenced their special surveys with dry-dock in order to complete them during the third quarter of 2024, for a total cost of $3.7 million. On January 29, 2025, the Company signed an agreement to sell M/V Tasos, a 75,100 dwt drybulk vessel, built in 2000, for demolition, for approximately $5 million. The vessel was delivered to its buyers, an unaffiliated third party, on March 17, 2025, resulting in a gain on sale of $2.1 million. Interest and other financing costs for the first half of 2025 amounted to $3.5 million compared to $4.1 million for the same period of 2024. This decrease is mainly due to the decreased benchmark rates of our loans, partly offset by the increased average debt during the first half of 2025, as compared to the same period of last year. For the six months ended June 30, 2025, the Company recognized a $0.1 million realized gain and a $0.2 million unrealized loss on one interest rate swap. For the six months ended June 30, 2024, the Company recognized a $0.1 million realized gain and a $0.2 million unrealized gain on one interest rate swap and a $0.3 million gain on FFA contracts. The Company reported a net loss for the period of $7.1 million and a net loss attributable to controlling shareholders of $6.8 million, as compared to a net loss of $2.2 million and a net loss attributable to controlling shareholders of $2.2 million, for the first half of 2024. The net loss attributable to the non-controlling interest of $0.3 million in the first half of 2025 represents the loss attributable to the 39% ownership of the Partnership. Adjusted EBITDA for the first half of 2025 was $0.9 million compared to $7.1 million achieved during the first half of 2024. Basic and diluted loss per share attributable to controlling shareholders for the first half of 2025 was $2.47, calculated on 2,737,297 basic and diluted weighted average number of shares outstanding compared to loss per share of $0.81, calculated on 2,721,952 basic and diluted weighted average number of shares outstanding. Excluding the effect on the net loss attributable to controlling shareholders for the first half of the year of the unrealized (gain) / loss on derivatives and the net gain on sale of a vessel, the adjusted loss attributable to controlling shareholders for the six-month period ended June 30, 2025, would have been $3.17 per share basic and diluted, compared to adjusted loss of $1.35 per share basic and diluted, respectively, for the six-month period ended June 30, 2024. As previously mentioned, usually, security analysts do not include the above item in their published estimates of earnings per share. Fleet Profile: The EuroDry Ltd. fleet profile is as follows:

(*) TC denotes time charter. Charter duration indicates the earliest redelivery date (**) The average Baltic Supramax S10TC Index is an index based on ten Supramax time charter routes. (***) The entity owning the vessel is 61% owned by EuroDry and 39% by NRP Investors. (****) Gross Ballast Bonus. Full report About EuroDry Ltd. EuroDry Ltd. was formed on January 8, 2018 under the laws of the Republic of the Marshall Islands to consolidate the drybulk fleet of Euroseas Ltd. into a separate listed public company. EuroDry was spun-off from Euroseas Ltd on May 30, 2018; it trades on the NASDAQ Capital Market under the ticker EDRY. EuroDry operates in the dry cargo, drybulk shipping market. EuroDry's operations are managed by Eurobulk Ltd., an ISO 9001:2008 and ISO 14001:2004 certified affiliated ship management company and Eurobulk (Far East) Ltd. Inc., which are responsible for the day-to-day commercial and technical management and operations of the vessels. EuroDry employs its vessels on spot and period charters and under pool agreements. The Company has a fleet of 12 vessels, including 4 Panamax drybulk carriers, 5 Ultramax drybulk carriers, 2 Kamsarmax drybulk carriers and 1 Supramax drybulk carrier. EuroDry's 12 drybulk carriers have a total cargo capacity of 842,886 dwt. After the delivery of two Ultramax vessels in 2027, the Company's fleet will consist of 14 vessels with a total carrying capacity of 969,886 dwt. (1) Adjusted EBITDA, Adjusted net loss attributable to controlling shareholders and Adjusted loss per share are not recognized measurements under US GAAP (GAAP) and should not be used in isolation or as a substitute for EuroDry's financial results presented in accordance with GAAP. Refer to a subsequent section of the Press Release for the definitions and reconciliation of these measurements to the most directly comparable financial measures calculated and presented in accordance with GAAP. EuroDry Ltd. press release

|