|

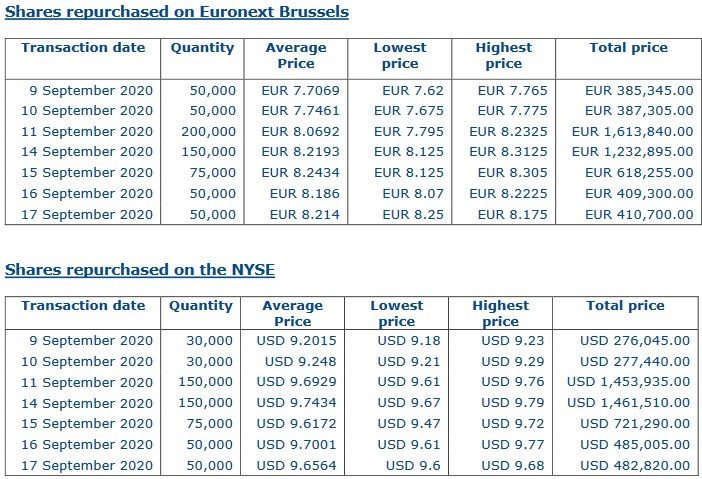

Antwerp, Belgium - 18 September 2020 Euronav NV (NYSE: EURN & Euronext: EURN) (“Euronav” or the “Company”) announces that the Company has purchased on the NYSE and on Euronext Brussels a total of 1,160,000 of its own shares for an aggregate price of EUR 9,377,610.69 (USD 11,196,867.16) as part of its capital allocation strategy and returns to shareholder policy. Following these transactions, the Company now owns 15,485,373 shares (7.04 % of the total outstanding share count). Further details on these transactions are as follows:

The Company will monitor market conditions to decide to continue buying back shares,taking into account a variety of factors, including regulatory or legal requirements andother corporate considerations. The Supervisory Board and Management Board firmly believe this affirmative action creates long term value for all stakeholders given the disconnect between equity and net asset values at present and reflects the strength of Euronav’s balance sheet and the confidence of Board and Management in the long term value in the Company’s shares.Clarksons Securities continues to act as an independent broker to coordinate and execute share repurchases on the exchanges of Euronext Brussels and/or the NYSE. About Euronav Euronav is an independent tanker company engaged in the ocean transportation and storage of crude oil. The Company is headquartered in Antwerp, Belgium, and has offices throughout Europe and Asia. Euronav is listed on Euronext Brussels and on the NYSE under the symbol EURN. Euronav employs its fleet both on the spot and period market. VLCCs on the spot market are traded in the Tankers International pool of which Euronav is one of the major partners. Euronav’s owned and operated fleet consists of 2 V-Plus vessels, 45 VLCCs (four to be delivered), 25 Suezmaxes (two of which are in a joint venture) and 2 FSO vessels (both owned in 50%-50% joint venture). Euronav NV press release

|