|

The past four weeks have seen FFA trading volumes average 22,500 lots per week compared to the year-to-date weekly average of less than 17,000 lots. This is the highest level of FFA trading since October 2012, which was also the last time the Capesize market pushed above $10,000/day. FIS Managing Director John Banaszkiewicz said: “This summer is proving to be one of surprises for the dry FFA market. Combined year to date volumes are down 8% but the recent rise in activity shows this is a market that is still alive and kicking. With rates finally above operating costs, owners and operators have much more incentive to hedge their price risk and trade in greater volume. This has been reflected in increased interest not just on Capesize FFAs but also on Panamax and Supramax contracts.”

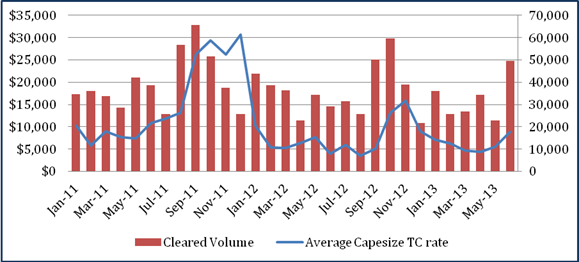

Average Capesize TC Rate v Cleared Volume. Source: Clearing Houses and Baltic Exchange The strong rebound of interest in Capesize trading can be explained by the high levels of volatility present in this sector. So far in 2013, the Capesize market has shown volatility of 78%, compared to iron ore at around 30% and fuel oil around 20%. The upturn in the Capesize spot market has been helped by a rebound in iron ore prices and an increase in chartering activity as Chinese buyers restock following a prolonged period of running down backlog levels. In addition, there appears to be greater confidence in steel market prospects for the months to come, while deliveries of new vessels have slowed. About FIS FIS is a leading provider of impartial and accurate risk management advice to customers in freight, steel, iron ore and fertilizer derivative markets and also provides physical commodity and shipbroking services. Founded in 2002, FIS has enjoyed sustained growth in each year of its operation and has expanded via its network of trading associates and branch offices to offer coverage in the United States, UK, Dubai, India South Korea, Singapore and Shanghai. The company is registered and regulated by the Financial Conduct Authority (FCA) in UK. Learn more about FIS at: www.freightinvestor.com FIS press release |

FFA traded volumes on big upswing as daily Cape spot rates

FFA traded volumes on big upswing as daily Cape spot rates