|

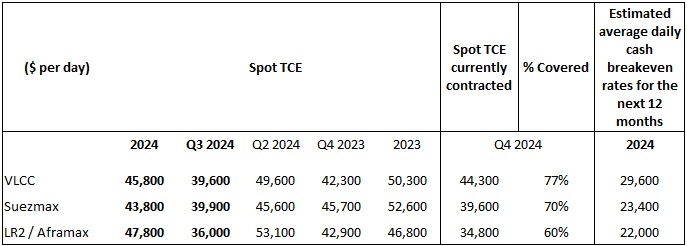

27.11.2024 Frontline plc (the "Company", "Frontline," "we," "us," or "our"), today reported unaudited results for the three and nine months ended September 30, 2024: Highlights • Profit of $60.5 million, or $0.27 per share for the third quarter of 2024. • Adjusted profit of $75.4 million, or $0.34 per share for the third quarter of 2024. • Declared a cash dividend of $0.34 per share for the third quarter of 2024. • Reported revenues of $490.3 million for the third quarter of 2024. • Achieved average daily spot time charter equivalent earnings ("TCEs")1 for VLCCs, Suezmax tankers and LR2/Aframax tankers in the third quarter of $39,600, $39,900 and $36,000 per day, respectively. • Sold its oldest Suezmax tanker, built in 2010, for a net sales price of $48.5 million and delivered the vessel to its new owner in October 2024. The transaction generated net cash proceeds of $36.5 million after repayment of existing debt. • Fully repaid the shareholder loan with Hemen Holding Limited, the Company's largest shareholder ("Hemen") and the $275.0 million senior unsecured revolving credit facility with an affiliate of Hemen for an aggregate amount of $470.0 million in the second, third and fourth quarters of 2024. • Entered into a sale-and-leaseback agreement in an amount of up to $512.1 million to refinance 10 Suezmax tankers. The refinancing is expected to generate net cash proceeds of approximately $101.0 million in the fourth quarter of 2024.

"The third quarter of 2024 performed in line with seasonal expectations, as oil demand slowed over the summer months and domestic demand by oil exporting countries in the Middle East increased. We continue to sail in a troubled geopolitical landscape and with lower year-on-year demand in Asia, and especially China, the tanker markets have yet to experience the seasonal upswing into winter. The increase in sanctioned oil trade and movement of illicit barrels have negatively impacted our trade environment. However, global oil demand is still growing, and with limited new tanker capacity coming, Frontline continues to profit as we run our cost-efficient operation and modern fleet. It will be interesting to see how the tanker market, including the trade of oil and energy, is impacted by politics as we approach 2025." Inger M. Klemp, Chief Financial Officer of Frontline Management AS, added: "In 2024 we have optimized the capital structure of the Company by refinancing debt of 36 vessels, which has extended maturities and improved margins, divesting eight older vessels and the subsequent repayment of the Hemen shareholder loan and the $275.0 million senior unsecured revolving credit facility with an affiliate of Hemen in an aggregate amount of $470.0 million. We continue to focus on maintaining our competitive cost structure, breakeven levels and solid balance sheet to ensure that we are well positioned to generate significant cash flow and create value for our shareholders." Average daily TCEs and estimated cash breakeven rates

We expect the spot TCEs for the full fourth quarter of 2024 to be lower than the spot TCEs currently contracted, due to the impact of ballast days during the fourth quarter of 2024. See Appendix 1 for further details. Third Quarter 2024 Results

Tanker Market Update According to the Energy Information Administration ("EIA"), global oil consumption averaged 103.3 million barrels per day ("mbpd") in the third quarter of 2024, an increase of 0.7 mbpd compared to the same period last year. Despite an apparent decline in consumption in Asia and Oceania in the third quarter, the region has experienced growth over the past year, with India being a significant contributor to this increase. Oil supply has remained stable since the second quarter of 2024, averaging 102.5 mbpd. The Organization of the Petroleum Exporting Countries' ("OPEC") supply cut strategy continues to be in effect. Compared to the same quarter last year, total supply has increased by 0.7 mbpd, with non-OPEC countries contributing the most to this growth. Looking ahead, the EIA forecasts supply growth of 2.6 mbpd over the next year, potentially reaching an output of 105.1 mbpd. With the trade of sanctioned crude increasing, the global tanker fleet continues to age as vessels remain sailing despite the efforts of US, EU and G7. With such a large part of the overall trade employing questionable actors, an astonishing 6% of the global VLCC, Suezmax tanker and Aframax/LR2 tanker fleet is reported to be sanctioned by the US Office of Foreign Asset Control ("OFAC"). The average age of the tanker fleet continues to rise with 16.5% of the above-mentioned asset classes above 20 years of age, normally not used for oil transportation by compliant actors. We are seeing softer demand growth as Chinese imports decrease. In addition to an overall reduction in volumes, industry sources also point to the surprising growth in Iranian exports, further reducing transportation demand in the compliant market, and softening the balance of the entire global oil trade. However, we do not believe the muted demand growth in Asia, especially China, to be materially caused by the increased sale of alternative fuel vehicles ("AFV"). The high market share in new sales of AFVs does not make a significant dent in the overall population of passenger cars or heavy-duty trucks in these countries. Data from mature AFV markets, with significant higher penetration, suggest that oil and product demand only subside to a modest degree even in seemingly saturated AFV markets. We believe the softer demand growth can to a greater degree be explained by overall economic activity. In developed and mature economies, fuel tends to correlate to the general demand of other consumer goods, meaning oil and products demand will continue to be cyclical for many years to come. The current tanker orderbook for the asset classes owned by Frontline constitutes 17.0% of the existing global fleet, with orders amounting to 67 VLCCs, 95 Suezmax tankers, and 167 LR2 tankers. Most of the growth in the orderbooks is attributed to deliveries scheduled in 2026 and 2027, meaning the growth of the global fleet will remain modest in 2025. Due to the general age profile of the current fleet, the orderbook is not expected to significantly impact the overall outlook of the tanker fleet in the near term. The Fleet As of September 30, 2024, the Company's fleet consisted of 82 vessels owned by the Company (41 VLCCs, 23 Suezmax tankers, 18 LR2/Aframax tankers), with an aggregate capacity of approximately 17.9 million DWT. As of September 30, 2024, all but one vessel in the Company's fleet were Eco vessels and 46 were scrubber-fitted vessels with a total average age of 6.4 years, making it one of the youngest and most energy-efficient fleets in the industry. As of September 30, 2024, six of the Company's vessels (1 VLCCs, 1 Suezmax tanker, 4 LR2/Aframax tankers) were on time charter-out contracts with initial periods in excess of 12 months. In January 2024, the Company announced that it has entered into an agreement to sell its five oldest VLCCs, built in 2009 and 2010, for an aggregate net sale price of $290.0 million. Three of the vessels were delivered to the new owner during the first quarter of 2024, and the two remaining vessels were delivered in the second quarter of 2024 (one of which was classified as held for sale as of March 31, 2024). After repayment of existing debt on the five vessels, the transaction generated net cash proceeds of $208.0 million. The Company recorded a gain of $42.7 million in the first quarter of 2024 in relation to the three vessels delivered in the period and recorded a gain of $25.9 million in the second quarter of 2024 in relation to the delivery of the remaining two vessels. In January 2024, the Company entered into an agreement to sell one of its oldest Suezmax tankers, built in 2010, for a net sale price of $45.0 million. The vessel was delivered to the new owner during the second quarter of 2024. After repayment of existing debt on the vessel, the transaction generated net cash proceeds of $32.0 million, and the Company recorded a gain of $11.8 million in the second quarter of 2024. In March 2024, the Company entered into an agreement to sell another one of its oldest Suezmax tankers, built in 2010, for a net sale price of $46.9 million. The vessel was delivered to the new owner during the second quarter of 2024. After repayment of existing debt on the vessel, the transaction generated net cash proceeds of $34.0 million, and the Company recorded a gain of $13.8 million in the second quarter of 2024. In June 2024, the Company entered into an agreement to sell its oldest Suezmax tanker, built in 2010, for a net sale price of $48.5 million. The vessel was delivered to the new owner in October 2024. After repayment of existing debt on the vessel, the transaction generated net cash proceeds of $36.5 million, and the Company expects to record a gain of approximately $18.0 million in the fourth quarter of 2024. In March 2024, the Company entered into a fixed rate time charter-out contract for one VLCC to a third party on a three-year time charter at a daily base rate of $51,500. The charter commenced in the third quarter of 2024. In April 2024, the Company entered into a time charter-out contract for one Suezmax tanker to a third party on a three-year time charter at a daily base rate of $32,950 plus 50% profit share. Corporate Update In June 2024, the Company attended an introductory hearing before the Enterprise Court in Antwerp, Belgium, in response to a summons received from certain funds managed by FourWorld Capital Management LLC ("FourWorld") in connection with their claims pertaining to the integrated solution for the strategic and structural deadlock within Euronav NV ("Euronav") announced on October 9, 2023, and Euronav's acquisition of CMB.TECH NV. FourWorld claims that the transactions should be rescinded and in addition has requested the court to order Compagnie Maritime Belge NV and Frontline to pay damages in an amount to be determined during the course of the proceedings. A procedural calendar has been agreed and the case is scheduled for oral court pleadings in May 2026, after which a judgment will be rendered. The Company finds the claims to be without merit and intends to vigorously defend against them. The Board of Directors declared a dividend of $0.34 per share for the third quarter of 2024. The record date for the dividend will be December 11, 2024, the ex-dividend date is expected to be December 11, 2024, for shares listed on the New York Stock Exchange and December 10, 2024, for shares listed on the Oslo Stock Exchange, and the dividend is scheduled to be paid on or about December 31, 2024. The Company had 222,622,889 ordinary shares outstanding as of September 30, 2024. The weighted average number of shares outstanding for the purpose of calculating basic and diluted earnings per share for the third quarter of 2024 was 222,622,889. Financing Update In November 2023, the Company entered into a senior secured term loan facility in an amount of up to $1,410.0 million with a group of our relationship banks to partly finance the acquisition of 24 VLCCs from Euronav (the "Acquisition"). The facility has a tenor of five years, carries an interest rate of Secured Overnight Financing Rate ("SOFR") plus a margin in line with the Company's existing loan facilities and has an amortization profile of 20 years commencing on the delivery date from the yard. In December 2023, the Company drew down $891.3 million under the facility to partly finance the Acquisition. Up to $518.7 million remained available and undrawn under the facility as of December 31, 2023, all of which was drawn down to partly finance the remaining 13 vessels delivered as a result of the Acquisition in the first quarter of 2024. In November 2023, the Company entered into a subordinated unsecured shareholder loan in an amount of up to $539.9 million with Hemen to partly finance the Acquisition (the "Hemen shareholder loan"). The Hemen shareholder loan has a tenor of five years and carries an interest rate of SOFR plus a margin equal to the $1,410.0 million facility, in line with the Company's existing loan facilities. In December 2023, the Company drew down $235.0 million under the Hemen shareholder loan to partly finance the Acquisition. Up to $304.9 million remained available to be drawn as of December 31, 2023. In January 2024, the Company drew down $60.0 million to partly finance the remaining 13 vessels delivered as a result of the Acquisition in the first quarter of 2024. In June 2024, the Company repaid $147.5 million under the Hemen shareholder loan. In August 2024, the Company repaid the Hemen shareholder loan in full. In December 2023, the Company drew down $99.7 million under its $275.0 million senior unsecured revolving credit facility with an affiliate of Hemen to partly finance the Acquisition. In April 2024, the Company repaid $100.0 million under the facility. In October 2024, the Company repaid $75.0 million under the facility. Up to $275.0 million remains available to be drawn following the repayment. In May 2024, the Company entered into a senior secured term loan facility in an amount of up to $606.7 million with China Exim Bank and DNB, insured by China Export and Credit Insurance Corporation, to refinance eight Suezmax tankers and eight LR2 tankers. The facility has a tenor of approximately nine years, carries an interest rate of SOFR plus a margin in line with the Company's existing loan facilities and has an amortization profile of approximately 19.7 years commencing on the delivery date from the yard. In June 2024, the Company drew down $306.5 million under the facility. In August 2024, the Company drew down the remaining $300.2 million under the facility. The refinancing generated net cash proceeds of $275.0 million in the second and third quarter of 2024. Full report Frontline Ltd. press release

|