|

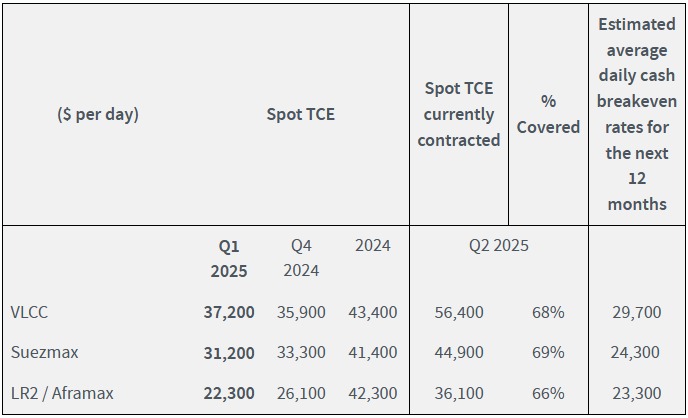

Frontline Plc reports results for the first quarter ended March 31, 2025 23.05.2025 Frontline plc (the "Company", "Frontline," "we," "us," or "our"), today reported unaudited results for the three months ended March 31, 2025: Highlights • Profit of $33.3 million, or $0.15 per share for the first quarter of 2025. • Adjusted profit of $40.4 million, or $0.18 per share for the first quarter of 2025. • Declared a cash dividend of $0.18 per share for the first quarter of 2025. • Reported revenues of $427.9 million for the first quarter of 2025. • Achieved average daily spot time charter equivalent earnings ("TCEs")1 for VLCCs, Suezmax tankers and LR2/Aframax tankers in the first quarter of $37,200, $31,200 and $22,300 per day, respectively. • Entered into three senior secured credit facilities in February 2025 for a total amount of up to $239.0 million to refinance the outstanding debt on three VLCCs and one Suezmax tanker maturing in 2025 and, in addition, provide revolving credit capacity in a total amount of up to $91.9 million. • Entered into one senior secured term loan facility in April 2025 in an amount of up to $1,286.5 million to refinance the outstanding debt on 24 VLCCs approximately three and a half years prior to maturity to reduce the margin.

Inger M. Klemp, Chief Financial Officer of Frontline Management AS, added: "Through our refinancings in 2025, we have further strengthened our strong liquidity, leaving the Company with no meaningful debt maturities until 2030, and further reduced our borrowing costs and cash breakeven rates. We continue to focus on maintaining our competitive cost structure, breakeven levels and solid balance sheet to ensure that we are well positioned to generate significant cash flow and create value for our shareholders." Average daily TCEs and estimated cash breakeven rates

Full report Frontline Plc. press release

|