|

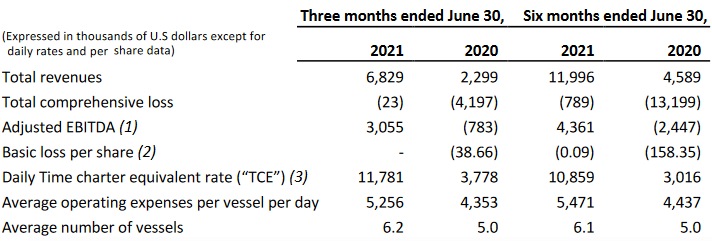

Glyfada, Greece - September 27, 2021 Globus Maritime Limited ("Globus", the "Company", "we", or "our") (NASDAQ: GLBS), a dry bulk shipping company, today reported its unaudited consolidated operating and financial results for the quarter and six- month period ended June 30, 2021. Financial Highlights • In H1 2021, Total revenues increased by about 161% compared to H1 2020. • The Adjusted EBITDA for H1 2021 increased by about 6.8 million compared to H1 2020. • The Total comprehensive loss for H1 2021 decreased by about 94% compared to H1 2020. • As of June 30, 2021, and December 31, 2020, our cash and bank balances and bank deposits (including restricted cash) were $78.5 and $21.1 million, respectively, an increase of 272%. • As of June 30, 2021, the total outstanding borrowings under our Loan agreements decreased to $34.25 million compared to $37 million as of December 31, 2020, gross of unamortized debt discount, a decrease of about 7%

(2) The weighted average number of shares for the six-month period ended June 30, 2021 was 9,001,704 compared to 83,354 shares for the six-month period ended June 30, 2020. The weighted average number of shares for the three-month period ended June 30, 2021 was 10,774,058 compared to 108,577 shares for the three-month period ended June 30, 2020. (3) Daily Time charter equivalent rate ("TCE") is a measure not in accordance with generally accepted accounting principles ("GAAP"). See a later section of this press release for a reconciliation of Daily TCE to Voyage revenues. Current Fleet Profile As of the date of this press release, Globus’ subsidiaries own and operate seven dry bulk carriers, consisting of four Supramax, one Panamax and two Kamsarmax.

Current Fleet Deployment

Management Commentary "During the second quarter we have seen the market gaining momentum. We are pleased to see increased rates across all sectors, the factors being demand as well as supply driven. On the demand side, we see a healthy demand of commodities both on the major as well as the minor bulks. There is significant congestion in ports all around the globe mainly due to COVID-19 related delays and complications. The combined effect of a healthy demand and a limit on the supply of ships helps the market and elevates rates. Since we expect the market to remain strong for the medium term and as our fleet comes out from legacy charters, we will be able to take advantage of the strong rates by positioning it accordingly. During the second Quarter we continued to improve our balance sheet and build up our fleet. We have managed to refinance and reduce our bank debt at much lower levels compared to our previous loan agreements with the effects to be visible in the following quarters and years. We feel that the new refinancing and new relationship with a respectable financial institution provides the Company with a good base for the future. In early June we have taken delivery of m/v Diamond Globe further expanding and modernizing our fleet. As previously communicated the vessel assumed a charter cover until about the end of the year. Additionally, we have recently announced the delivery of our new vessel m/v Power Globe joining our fleet which immediately performed a short trip at about $31,000 gross per day before proceeding to drydocking for her scheduled maintenance. We will examine the market and hopefully find lucrative business for the vessel when the scheduled maintenance is completed. Furthermore, last week we entered into an agreement to acquire a 2015 Japanese Kamsarmax for $28,4 million and expect to take delivery of the vessel during the 4th Quarter of 2021. We will examine the charter and market condition closer to the delivery date and do our best to secure the highest rate possible at that time. The addition of this new vessel will expand our fleet and its carrying capacity further and align well with our renewal and expansion strategy. We consider this to be a good addition to the fleet which will further strengthen the position of the company in the market as well as help us build new relationships with customers. COVID-19 is affecting most parts of our operations, we see delays related to the pandemic on most aspects that relate to technical as well as commercial matters. There are delays on schedules of loading, discharging, crew exchanges and spare part procurement as well as repairs, the delays are also accompanied with increased costs of such operations. We are trying our best as a company to mitigate any effects and delays always keeping in mind international and local regulations as well as our vessels and crew safety and wellbeing. We are focused in helping and supporting our seafarers during these trying times; we want them to be healthy, happy and demonstrate high morale on board and will continue doing whatever is necessary for their safety and good physical and mental health. Finally, we believe that the company has a strong balance sheet, and the growing fleet will help us to fully take advantage of the strong market. We are keeping our focus on future environmental regulations and continue to modernize and build up our fleet on that basis. We are confident that with a bigger and modernized fleet will be able to take advantage of the strong market and by extent build long term value for our shareholders." Full report About Globus Maritime Limited Globus is an integrated dry bulk shipping company that provides marine transportation services worldwide and presently owns, operates and manages a fleet of seven dry bulk vessels that transport iron ore, coal, grain, steel products, cement, alumina and other dry bulk cargoes internationally. Globus' subsidiaries own and operate seven vessels with a total carrying capacity of 463,765 deadweight tons and a weighted average age of 10.2 years as of June 23, 2021. Globus Maritime Limited press release

|