|

Accelerating our transformation into a social infrastructure company March 10, 2025

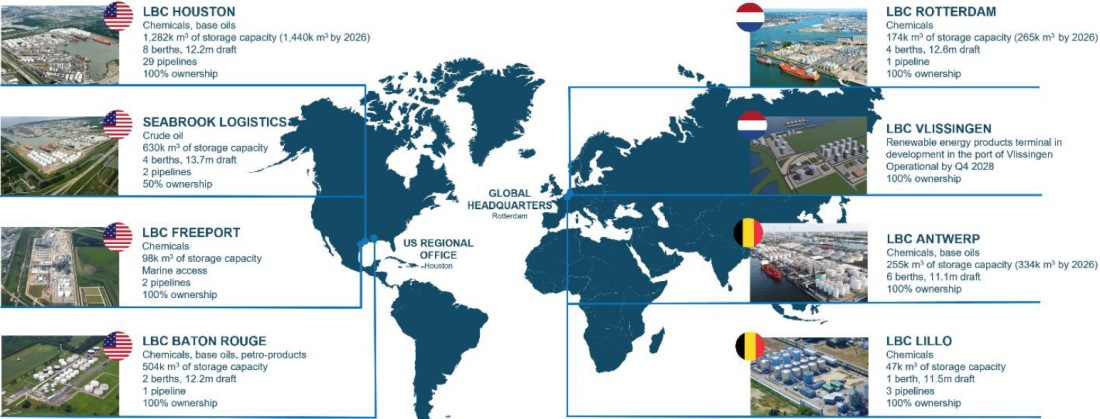

LBC is one of the largest global independent tank terminal companies, primarily handling and storing chemicals, operating seven terminals in the world's leading chemical hubs in Europe (Antwerp and Rotterdam) and the US Gulf Coast region (Houston, Freeport and Baton Rouge). With a total storage capacity of approximately 3 million cubic metres, berth facilities, pipelines and loading facilities for rail and truck transport, LBC supports the supply chains of customers such as chemical manufacturers and energy companies, through storage services at shipping and arrival ports. MOL Group positions the chemical logistics business as a business of growth, and this acquisition is part of that strategy. MOL has already expanded our business scale in the chemical tanker business by acquiring shares in Nordic Tankers in 2019 and Fairfield Chemical Carriers in 2024, boasting one of the largest fleets in the world. With the acquisition of LBC, MOL have gained onshore storage capabilities at tank terminals and expanded our lineup to include everything from maritime transport to small-lot transport using tank containers. This enables us to flexibly meet diverse customer transportation needs and establish a "Total Chemical Logistics Service" system, aiming to lead the global chemical logistics industry. In addition, with demand for the transportation of ammonia and CO₂ expected to grow as a result of a more decarbonized society, MOL Group will accelerate the development of its next-generation energy business by adding onshore storage to its logistics offering through the acquisition of LBC. LBC plans to expand its business by increasing tank capacity, and based on these plans, the investment return (Equity IRR) from this acquisition is expected to be approximately 10%. Moving forward, MOL aims to achieve further growth by leveraging synergies with chemical tanker business, and tank container business, as well as advancing its next-generation energy business. The acquisition of LBC is in line with MOL Group's “BLUE ACTION 2035” management plan to become a Social Infrastructure Group as it will rebalance our Group portfolio to non-shipping revenues and assets and a more stable revenue business and reduce the exposure to market driven shipping business.

Image by LBC Tank Terminals Group LBC is one of the largest global independent tank terminal companies, primarily handling and storing chemicals, operating seven terminals in the world's leading chemical hubs in Europe (Antwerp and Rotterdam) and the US Gulf Coast region (Houston, Freeport and Baton Rouge). With a total storage capacity of approximately 3 million cubic metres, berth facilities, pipelines and loading facilities for rail and truck transport, LBC supports the supply chains of customers such as chemical manufacturers and energy companies, through storage services at shipping and arrival ports. MOL Group positions the chemical logistics business as a business of growth, and this acquisition is part of that strategy. MOL has already expanded our business scale in the chemical tanker business by acquiring shares in Nordic Tankers in 2019 and Fairfield Chemical Carriers in 2024, boasting one of the largest fleets in the world. With the acquisition of LBC, MOL have gained onshore storage capabilities at tank terminals and expanded our lineup to include everything from maritime transport to small-lot transport using tank containers. This enables us to flexibly meet diverse customer transportation needs and establish a "Total Chemical Logistics Service" system, aiming to lead the global chemical logistics industry.

Image by LBC Tank Terminals Group In addition, with demand for the transportation of ammonia and CO₂ expected to grow as a result of a more decarbonized society, MOL Group will accelerate the development of its next-generation energy business by adding onshore storage to its logistics offering through the acquisition of LBC. LBC plans to expand its business by increasing tank capacity, and based on these plans, the investment return (Equity IRR) from this acquisition is expected to be approximately 10%. Moving forward, MOL aims to achieve further growth by leveraging synergies with chemical tanker business, and tank container business, as well as advancing its next-generation energy business. The acquisition of LBC is in line with MOL Group's “BLUE ACTION 2035” management plan to become a Social Infrastructure Group as it will rebalance our Group portfolio to non-shipping revenues and assets and a more stable revenue business and reduce the exposure to market driven shipping business. - There are no changes to the year-end dividend forecast that has been announced on January 31, 2025. (Note 1) LBC Tank Terminals Group Holding Netherlands Cooperatief U.A. Headquarters: Rotterdam, the Netherlands Establishment: October, 2013 Business: Operating storage facilities for liquid chemicals, oil and refined petroleum products Shareholder Composition: Lanturn SCA (Note 2) : 34.971% Stichting Depositary PGGM Infrastructure Funds (Note 3) : 32.473% Stichting Depositary APG Infrastructure Pool 2011 (Note 4) : 32.473% LBC Management Company B.V. : 0.082% (Note 2) An investment vehicle managed by Ardian, a world-leading private investment house. (Note 3) A wholly-owned subsidiary of PGGM, a Dutch pension fund cooperative, managing the pension investments for PFZW, the Dutch health care pension scheme with three million participants. (Note 4) An investment fund managed by APG Asset Management, the investment- and asset manager of ABP, the largest pension fund in the Netherlands.

Locations of LBC's terminals as of the end of 2024. Image by MOL. Mitsui O.S.K. Lines, Ltd. press release

|