|

Grand Cayman, Cayman Islands, Sept. 08, 2022

Net Income

• $45.0 million net income in Q2 2022

• $40.0 million net income in H1 2022

Revenue

• 10.9% increase to $159.2 million in Q2 2022

• 10.1% increase to $287.0 million in H1 2022

Cash from operating activities

• $69.7 million cash provided by operating activities in Q2 2022

• $86.1 million cash provided by operating activities in H1 2022

|

|

• 22.8% increase to $98.9 million in Q2 2022

• 27.8% increase to $172.7 million in H1 2022

Recent Developments

• $835.0 million sale of 36-vessel drybulk fleet completed

• $784.2 million reduction in liabilities

Post sale

• 63.8% controlling stake in NSAL

• 10.3% passive stake in NMM

Navios Maritime Holdings Inc. ("Navios Holdings" or the "Company") (NYSE: NM), a global seaborne shipping and logistics company, today reported financial results for the second quarter and six months ended June 30, 2022.

Angeliki Frangou, Chairwoman and Chief Executive Officer, stated, "I am pleased with the results for the second quarter of 2022. In the second quarter of 2022, Navios Holdings reported revenue of $159.2 million, EBITDA of $98.9 million and net Income of $45.0 million."

Angeliki Frangou, continued, "We completed the $835.0 million sale of our dry fleet and used the proceeds to pay down $784.2 million of debt. Going forward, we will refocus on our controlling interest in Navios South American Logistics, a logistics and infrastructure provider in South America. Navios Logistics owns, among other assets, the only dedicated iron ore port and the largest independent grain port in the Hidrovia region. The transshipment facilities are located at the mouth of the river, where water levels are unaffected by the droughts, within a tax-free zone in Uruguay."

HIGHLIGHTS

Recent Developments

In July 2022 Navios Holdings agreed to sell its 36-vessel drybulk fleet for aggregate consideration of $835.0 million consisting of cash and the assumption of bank debt and finance leases related to the vessels, and subject to a working capital adjustment at closing (the "Transaction"), to Navios Maritime Partners L.P. ("Navios Partners") (NYSE: NMM). The Transaction closed in two tranches. The first tranche, involving the sale of 15 vessels, was completed on July 29, 2022. The second tranche, involving the sale of the remaining 21 vessels, was completed on September 8, 2022.

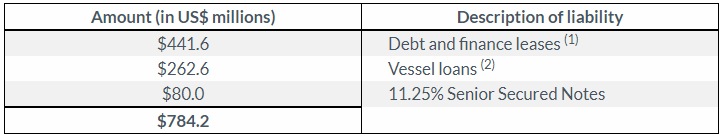

The aggregate Transaction consideration reduced Navios Holdings' liabilities by approximately $784.2 million, consisting of:

(1) Assumed by Navios Partners, includes bank debt and finance lease liabilities as well as obligations from bareboat arrangements on a finance lease basis as of June 30, 2022, as adjusted at the closing of the Transaction.

(2) Mandatory repayment of loans due to N Shipmanagement Acquisition Corp. and its subsidiaries, an entity affiliated with the Chairwoman and Chief Executive Officer of Navios Holdings.

The Transaction was negotiated and unanimously approved by a Special Committee of Navios Holdings. The Transaction was also unanimously approved by the board of directors of Navios Holdings. Latham & Watkins LLP acted as legal advisor and Arctic Securities AS acted as sole financial advisor to the Special Committee.

NM Post Sale

Following the closing of the Transaction, Navios Holdings exited direct fleet ownership and the business previously represented by the Dry Bulk Vessel Operations segment. Going forward, the Company plans to focus on growing the Navios South American Logistics Inc. ("Navios Logistics") business. Navios Holdings owns a 63.8% controlling equity stake in Navios Logistics, and the results of operations of Navios Logistics are consolidated into Navios Holdings' financial statements. Navios Logistics is a leading infrastructure and logistics company in the Hidrovia region of South America.

Navios Holdings also continues to hold a 10.3% interest in Navios Partners accounted for as an equity investment.

Non-GAAP Measures

EBITDA, is a non-U.S. GAAP financial measures and should not be used in isolation or as substitution for Navios Holdings' or Navios Logistics' results calculated in accordance with U.S. GAAP.

See Exhibit I under the heading, "Disclosure of Non-GAAP Financial Measures," for a discussion of EBITDA and EBITDA of Navios Logistics (on a stand-alone basis) and a reconciliation of such measures to the most comparable measures calculated under U.S. GAAP.

Full report

About Navios Maritime Holdings Inc.

Navios Maritime Holdings Inc. (NYSE: NM) owns a controlling equity stake in Navios South American Logistics Inc., a leading infrastructure and logistics company in the Hidrovia region of South America and a passive equity interest in Navios Maritime Partners L.P., a leading, US publicly listed shipping company which owns and operates dry cargo and tanker vessels. For more information about Navios Holdings, please visit our website: www.navios.com.

About Navios South American Logistics Inc.

Navios South American Logistics Inc. is one of the largest logistics companies in the Hidrovia region of South America, focusing on the Hidrovia region river system, the main navigable river system in the region, and on cabotage trades along the eastern coast of South America. Navios Logistics serves the storage and marine transportation needs of its petroleum, agricultural and mining customers through its port terminals, river barge and coastal cabotage operations. For more information about Navios Logistics, please visit its website: www.navios-logistics.com.

About Navios Maritime Partners L.P.

Navios Maritime Partners L.P. (NYSE: NMM) is an international owner and operator of dry cargo and tanker vessels. For more information, please visit its website: www.navios-mlp.com.

Navios Maritime Holdings Inc. press release