|

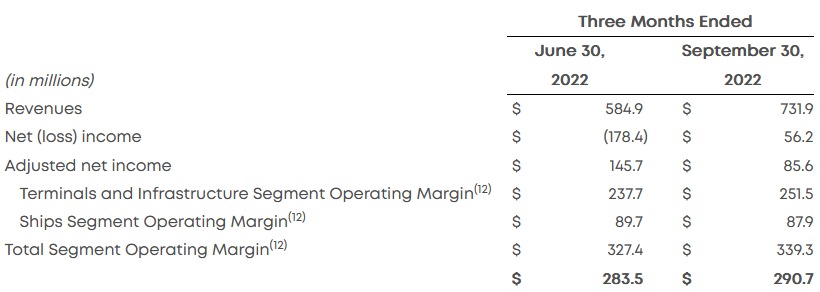

New York - 8 November 2022 New Fortress Energy Inc. (Nasdaq: NFE) ("NFE" or the "Company") today reported its financial results for the third quarter of 2022. Summary Highlights Pleased to report Q3 2022 Adjusted EBITDA of $291 million and $1.17 billion over the trailing twelve months ended September 30, 2022. NFE's net income for Q3 2022 and trailing twelve months was $56 million and $271 million, respectively. Adjusted EPS for the period was $0.41 per share on a fully diluted basis, or EPS of $0.29 per share when including a non-cash impairment charge of $24 million resulting from an asset sale announced in Q2 and completed in Q4 2022. We are on track to achieve our Illustrative Adjusted EBITDA Goal of ~$1.1 billion for 2022. Recently announced increase of 2023 Illustrative Adjusted EBITDA Goal to ~$2.5+ billion (from ~$1.5+ billion), and Illustrative Adjusted EBITDA Goals(3) of ~$4+ billion and ~$5+ billion for 2024 and 2025, respectively. Increase in 2023 earnings goals driven primarily by expected Deployment of FLNG 1 in the first half of 2023, as well as higher expected operating margins and continued LNG portfolio optimization. Fast LNG Construction of our Fast LNG units is progressing rapidly with the first FLNG unit expected to achieve Mechanical Completion in March 2023 and commence Operations by mid-2023. Our Fast LNG units represent more than half of the world's expected incremental LNG supply in 2023-2024, and we expect will be utilized in the near term to address Europe's energy security issues. We expect our five Fast LNG units under Development to add approximately 7+ mtpa of new liquefaction capacity by the end of 2024 for a total LNG supply portfolio of approximately 9.5 mtpa. Mexico We signed binding agreements with CFE on November 3 in Mexico City for a new FLNG hub at Altamira (originally announced July 5). We are selling our 135 MW La Paz power plant to CFE for approximately $180mm. We are extending and expanding our gas supply agreement with CFE in Baja California Sur for ten years with improved pricing. We finalized our partnership terms with Pemex to jointly develop the Lakach deepwater natural gas field and to deploy a Fast LNG unit to that location. Balance Sheet Over the past two quarters, we simplified our capital structure, securing more than $2.0 billion of internally generated liquidity to fund our Fast LNG program. We closed the sale of CELSE, the owner of the Sergipe Power Plant and Facility in Brazil, and closed the transaction for Energos Infrastructure, our joint venture with Apollo in which NFE holds long-term charters for ten LNG vessels. Terminals Our commitment to our customers at our downstream terminals remains robust, and we progressed several projects during the quarter. The Eems Energy Terminal in The Netherlands commenced Operations in September utilizing our FSRU Energos Igloo. We expect the Eems Energy Terminal to increase LNG capacity in the near-term with NFE as a potential new capacity holder of re-gas slots. We are still on schedule to Complete our Barcarena and Santa Catarina terminal developments this year, and we are now preparing to commence Operations in 2023. We advanced pre-Development activities for our Ireland terminal, with plans for a 600 MW power plant, and expect to receive relevant permits by year-end 2022. Hydrogen We continue to progress Development activities in ZERO, our pure-play clean hydrogen business, with a plan to separately capitalize and a clear path for expansion. The Inflation Reduction Act of 2022 ("IRA") represents the largest climate investment in U.S. history and is expected to drive $4+ trillion in capital investment in U.S. energy infrastructure over the next ten years. The IRA(11) includes a $3/kg tax credit for the production of clean hydrogen, and we believe the U.S. is poised to become the leading venue in the world for industrial-scale clean hydrogen. We have commenced construction on our first hydrogen plant in Beaumont (120 MW, ~50 tpd), an industrial hub in Texas, and have several other projects in various stages of development. NFE's Board of Directors approved a dividend of $0.10 per share, with a record date of December 7, 2022 and a payment date of December 20, 2022. Financial Highlights

Full report About New Fortress Energy New Fortress Energy Inc. (NASDAQ: NFE) is a global energy infrastructure company founded to help address energy poverty and accelerate the world's transition to reliable, affordable, and clean energy. The company owns and operates natural gas and liquefied natural gas (LNG) infrastructure, ships and logistics assets to rapidly deliver turnkey energy solutions to global markets. Collectively, the company's assets and operations seek to support global energy security, enable economic growth, enhance environmental stewardship, and transform local industries and communities around the world. New Fortress Energy Inc. - press release

|