|

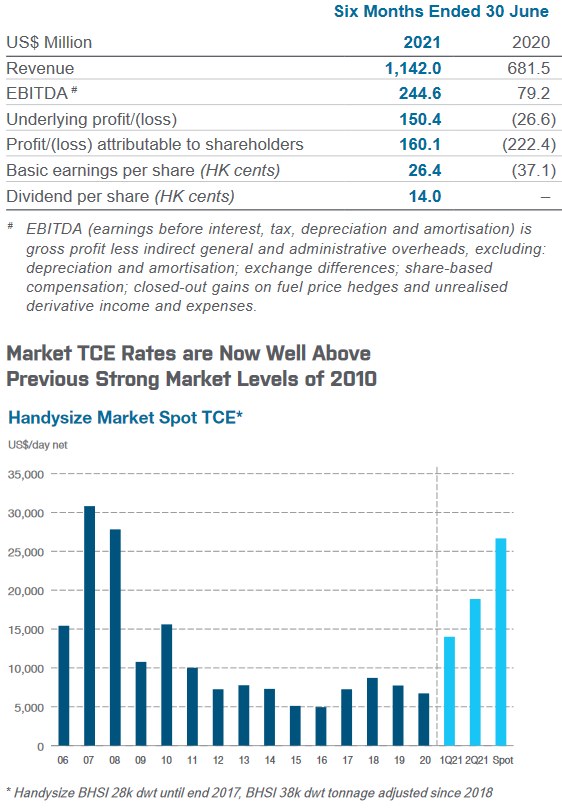

The dry bulk market went from strength to strength in the first half of 2021, and we recorded our best half-year results in 13 years In June we registered our strongest monthly underlying results ever, and we have covered substantially all of July and August at even higher daily TCE rates We expect continued healthy demand and reducing net fleet growth to result in higher average dry bulk freight earnings in the second half of 2021 The Board has declared an interim dividend of HK14 cents Hong Kong - 29 July 2021 Pacific Basin Shipping Limited (“Pacific Basin” or the “Company”, SEHK 2343), one of the world’s leading dry bulk shipping companies, today announced the unaudited condensed results of the Company and its subsidiaries (collectively the “Group”) for the six months ended 30 June 2021. Mr. Mats Berglund, CEO of Pacific Basin, said: “During the first half of 2021, we delivered our strongest half-year result in 13 years. We made an underlying profit of US$150.4 million, an EBITDA of US$244.6 million and a healthy return on equity of 28%. EPS was HK26.4 cents and the Board has declared an interim dividend of HK14 cents per share, in line with our dividend policy of paying out at least 50% of net profits. Our profitability improved progressively over the period, culminating in an underlying monthly result of US$53 million in June alone – the Company’s highest monthly result ever – and we have covered substantially all of July and August at even higher daily TCE rates, while the costs of our core fleet remain substantially fixed. It is primarily strong, broad-based and geographically diverse demand for our two most important commodity groups – minor bulks and grain – that is driving up freight rates in our markets. Minor bulk demand normally tracks growth in GDP, hence, with a 6% world GDP growth forecast and continued stimulus in many countries, the forecast for minor bulk demand in the rest of the year is positive. This is the strong market that our teams both ashore and on board have worked so hard to set ourselves up for, and it is very satisfying to now see the returns coming through. Our available liquidity has increased to US$417.1 million as at 30 June 2021, and our net borrowings of US$539.5 million were 31% of the net book value of our owned vessels Financial Highlights

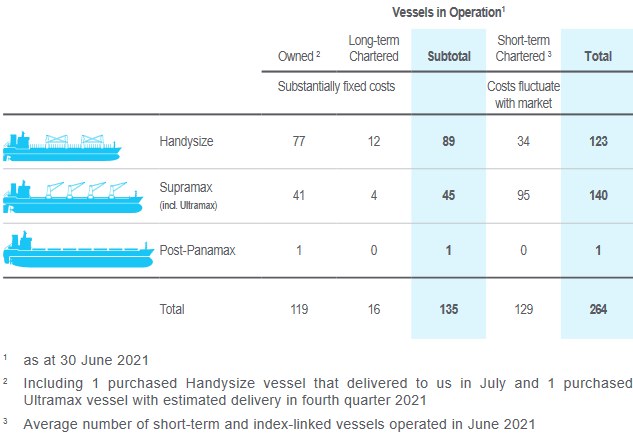

Benefiting from our Strategy of Significantly Growing our Owned Fleet Second-hand vessel values remain well below the previous strong market levels of 2010 despite freight rates being well above 2010 levels. We see further upside in second-hand values and have continued to buy good quality second-hand vessels. In line with our strategy, we have purchased six Ultramax vessels and two 38,000 dwt Handysize vessels since November last year, of which all but one Ultramax have now been delivered to us. We have strategically grown the Supra/Ultramax proportion of our fleet and now benefit from the larger earnings upside that these larger ships enjoy in strong markets. Four older, smaller Handysize ships that we agreed to sell in December and January left our fleet in the first half of the year. Including the Ultramax that has yet to deliver, we own 119 quality ships that are very well suited for our customers and trades and are now generating very attractive returns. Including chartered ships, we currently have around 270 ships on the water which is the biggest overall fleet we have ever controlled. IMO recently adopted global regulations to drive technical and operational measures to improve the carbon efficiency of existing ships over this decade with effect from January 2023. The EU intends to implement a similar scheme and to include shipping in its Emissions Trading System. We have adopted carbon efficiency enhancements and practices for many years which positions our ships well to comply, and we have the know-how and resources to embrace the coming changes in our industry Our Fleet (as at 30 June 2021)

Positive Market Outlook for the Second Half We expect continued healthy demand and reducing net fleet growth to result in higher average dry bulk freight earnings in the second half of 2021 compared to the first half. In the short term, we expect market tightness to continue with the imminent start to the northern hemisphere grain export season that typically drives rates in the third quarter. Dry bulk demand for the rest of the year is expected to continue to be broad based and benefit from economic stimulus and infrastructure projects, although with some uncertainty over the path of the pandemic and the longevity of policy support. We are optimistic about the longer term outlook for the dry bulk market. The orderbook is at an all-time low and we believe supply growth can remain at moderate levels because decarbonisation rules will result in shorter expected economic lives for newbuildings with conventional fuel oil engines, hence discouraging new ship ordering, and IMO rules will force slower speeds from 2023. Our large core fleet with an enlarged Supramax proportion, our customer-focused business model, our efficient cost structure and our strong team equip us to provide customers with sector-leading service and performance and position us well to take advantage of the strong market.” For details, please see our 2021 Interim Results Announcement in the Investor section of our website at www.pacificbasin.com/en/ir/news.php. Our full Interim Report will be published on or around 17 August 2021. Note: The English text of this press release shall prevail over the Chinese text in case of any inconsistency. About Pacific Basin Pacific Basin Shipping Limited (www.pacificbasin.com) is one of the world’s leading owners and operators of modern Handysize and Supramax dry bulk vessels. The Company is committed to sustainable shipping with a keen focus on seafarer health, safety and wellbeing, responsible environmental practice, performance optimisation for best fuel and carbon efficiency, and best-in-class service delivery. The Company currently operates around 270 dry bulk ships of which 119 are owned (including one expected to join the fleet in 4Q 2021) and the rest chartered. Pacific Basin is listed and headquartered in Hong Kong, and provides a quality service to over 500 customers, with about 4,300 seafarers and 360 shore-based staff in 13 offices in key locations around the world. Pacific Basin Shipping Limited press release.

|