|

(1) Please see the table at the back of this release for a reconciliation of TCE to Time Charter Revenue, EBITDA and Adjusted EBITDA to Net Income / (Loss), Adjusted Net Income / (Loss) to Net Income / (Loss) and Adjusted Earnings / (Loss) per common share to Earnings / (Loss) per common share, the most directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”).

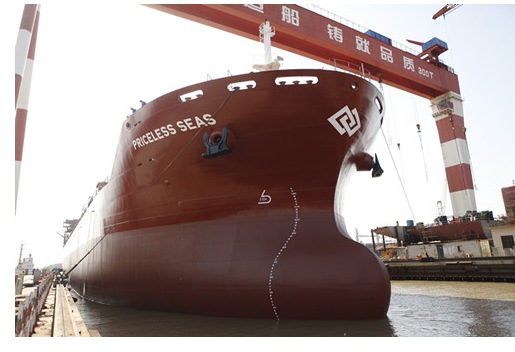

Furthermore, we extended the availability period of the syndicate facility led by Nordea Bank Finland Plc for nine months, securing the financing of our last Handysize newbuilding drybulk vessel (Hull no. 625) that is expected to be delivered in the fourth quarter of 2013. Overall, by successfully completing our debt restructuring program, we reduced our debt repayment requirements for 2013 and 2014 by $44.4 million and $6.9 million, respectively. Recent Fleet Developments and Time Charter Coverage Update On January 29, 2013, we took delivery of our third newbuilding vessel, the M/V Priceless Seas, a 37,202 dwt Handysize vessel, from the Zhejiang Ouhua Shipbuilding Co. in China. The vessel was financed purely with equity and therefore, no additional amount was drawn under the syndicate facility led by Nordea Bank Finland Plc. Currently, the M/V Priceless Seas is not subject to any mortgage. The M/V Priceless Seas is currently employed on a short-term time charter trip with STX Pan Ocean Co. Ltd. for a period of about one month and at a gross daily rate of $6,000. Pursuant to our time chartering strategy, we mainly employ vessels under fixed rate time charters for periods ranging from one to five years. Assuming all charter counterparties fully perform under the terms of the charters, based on the earliest redelivery dates and including our newbuilding vessels, we have secured employment for 55% and 7% of our fleet capacity for the remainder of 2013 and full year 2014, respectively. Management Commentary Commenting on the results, Michael Bodouroglou, Chairman and Chief Executive Officer of Paragon Shipping, stated, “We are pleased to announce our results for the fourth quarter of 2012. After the recognition of a $1.9 million gain from our debt restructuring, our EBITDA for the quarter was $6.9 million, while we reported a net income of $0.3 million, or 5 cents per share. On average, we operated 12.0 vessels, with a utilization rate in excess of 98%. In addition, on January 29, 2013 we took delivery of our third Handysize newbuilding vessel, the M/V Priceless Seas, and expanded our fleet size to 13 vessels. The respective vessel is currently debt-free, which results in a decreased breakeven-point and an increased contribution to the Company’s cash flow.” Mr. Bodouroglou continued, “We are also pleased to announce that we have successfully completed our debt restructuring by signing supplemental agreements with all of our lenders. Based on our debt restructuring program, we achieved the relaxation of several financial and security coverage ratio covenants and the overall increase of the Company’s projected liquidity by reducing our quarterly debt repayments by almost half and extending the profile of two facilities, which reduced our annual debt repayments by $44.4 million in 2013 and $6.9 million in 2014.” Mr. Bodouroglou concluded, “Overall, despite the severe and protracted downturn and the prevailing market conditions, in 2012 we continued to execute on our strategy of conservative growth and cash preservation.” Fourth Quarter 2012 Financial Results Gross time charter revenue for the fourth quarter of 2012 was $13.7 million, compared to $17.0 million for the fourth quarter of 2011. The Company reported a net income of 0.3 million, or $0.05 per basic and diluted share, for the fourth quarter of 2012, calculated on 6,354,014 weighted average number of basic and diluted shares outstanding for the period and reflecting the impact of the non-cash items discussed below. For the fourth quarter of 2011, the Company reported a net loss of $272.4 million, or $45.25 per basic and diluted share, calculated on 5,866,532 weighted average number of basic and diluted shares. Excluding all non-cash items described below, the adjusted net loss for the fourth quarter of 2012 was $2.1 million, or $0.33 per basic and diluted share, compared to adjusted net income of $0.5 million, or $0.09 per basic and diluted share, for the fourth quarter of 2011. EBITDA for the fourth quarter of 2012 was positive $6.9 million, compared to negative $262.4 million for the fourth quarter of 2011. EBITDA for the fourth quarter of 2012 was calculated by adding to net income of 0.3 million, net interest expense, including interest expense from interest rate swaps, and depreciation that in the aggregate amounted to $6.5 million. Adjusted EBITDA, excluding all non-cash items described below, was $4.4 million for the fourth quarter of 2012, compared to $9.9 million for the fourth quarter of 2011. The Company operated an average of 12.0 vessels during the fourth quarter of 2012, earning an average TCE rate of $10,563 per day, compared to an average of 10.3 vessels during the fourth quarter of 2011, earning an average TCE rate of $17,905 per day. Total adjusted operating expenses for the fourth quarter of 2012 equaled $7.4 million, or approximately $6,663 per day per vessel, including vessel operating expenses, management fees, general and administrative expenses and dry-docking costs, but excluding $0.1 million of share-based compensation for the period. For the fourth quarter of 2011, total adjusted operating expenses were $8.8 million, or approximately $9,218 per day per vessel, including the same items as mentioned above, but excluding $1.1 million of share-based compensation. Depreciation is computed using the straight-line method over the estimated useful life of the vessels, after considering the estimated salvage value. Each vessel’s salvage value is equal to the product of its lightweight tonnage and estimated scrap rate. In order to adjust the Company’s scrap rate estimates to be aligned with the historical average scrap rate, effective from October 1, 2012 and with prospective effect, we adjusted the estimated scrap rate used to calculate our vessels’ salvage value from $150 to $300 per lightweight ton. As of December 31, 2012, the Company owned approximately 16.4% of the outstanding common stock of Box Ships Inc. (NYSE:TEU) (“Box Ships”), a former wholly-owned subsidiary of the Company which successfully completed its initial public offering in April 2011. The investment in Box Ships is accounted for under the equity method and is separately reflected on the Company’s unaudited condensed consolidated balance sheets. For the fourth quarter of 2012, the Company recorded income of $0.4 million, representing its share of Box Ships’ net income for the period, compared to $1.2 million for the fourth quarter of 2011. In the fourth quarter of 2012, we received a cash amount of $0.8 million, representing dividend distributions from Box Ships, compared to $1.0 million received in the fourth quarter of 2011. Full report at: www.paragonship.com About Paragon Shipping Inc. Paragon Shipping is a Marshall Islands-based international shipping company with executive offices in Athens, Greece, specializing in the transportation of drybulk cargoes. The Company’s current fleet consists of thirteen drybulk vessels with a total carrying capacity of 816,472 dwt. In addition, the Company’s current newbuilding program consists of one Handysize drybulk carrier that is scheduled to be delivered in the fourth quarter of 2013 and two 4,800 TEU containerships that are scheduled to be delivered in 2014. Paragon Shipping has granted Box Ships Inc., an affiliated company, the option to acquire its two containerships under construction. For more information, visit: www.paragonship.com. The information contained on the Company’s website does not constitute part of this press release. Paragon Shipping Inc. press release |

We are pleased to announce that on February 8, 2013, we completed our debt restructuring by finalizing the documentation for amendments to the loan agreements with each of our lenders and successfully fulfilling all conditions precedent to these amendments.

We are pleased to announce that on February 8, 2013, we completed our debt restructuring by finalizing the documentation for amendments to the loan agreements with each of our lenders and successfully fulfilling all conditions precedent to these amendments.