|

Dec 27, 2023

1. INTRODUCTION

|

|

The acquisition of the Vessels is a discloseable transaction pursuant to Chapter 10 of the SGX-ST Listing Manual (the "Listing Manual"). The relative figures for the purchase of the Vessel Purchase computed on the bases set out in Rule 1006 of the Listing Manual and based on the audited consolidated financial statements of the Group for the financial year ended 31 December 2022 are as set out in Annex 1.

2. INFORMATION ABOUT THE VESSELS

The Vessels are both Bahama flagged ethylene gas vessels that were built in 2010 and 2009 respectively. The Company will determine the flag of these vessels closer to deliveries. The Vessels will be renamed as Sinar Ternate and Sinar Tidore when the deliveries are completed.

3. TERMS OF THE VESSEL PURCHASE

The memorandums of agreement for the Vessels were based on the SALEFORM 2012 (revised 1966, 1983 and 1986/87, 1993 and 2012) prescribed by the Norwegian Shipbrokers' Association for sale and purchase of vessels and adopted by the Baltic and International Maritime Council in 1956 with modification to cater for the specific purchase of the vessels. The memorandums of agreement did not contain any unusual requirements and was consistent with usual market conditions for the sale and purchase of vessel. The acquisition of the Vessels are conditional on each other.

4. PURCHASE PRICE AND BOOK VALUE

The aggregate acquisition price for the vessels is US$12,600,000. The book value of the Vessels will be equal to the acquisition price of the Vessels. The purchase considerations were arrived at on a willing-buyer willing-seller basis after taking into account various factors including the price range of comparable vessels provided by the ship broker as well as the age and proposed usage of the vessels. The acquisition will be financed through a combination of internal resources and bank borrowings.

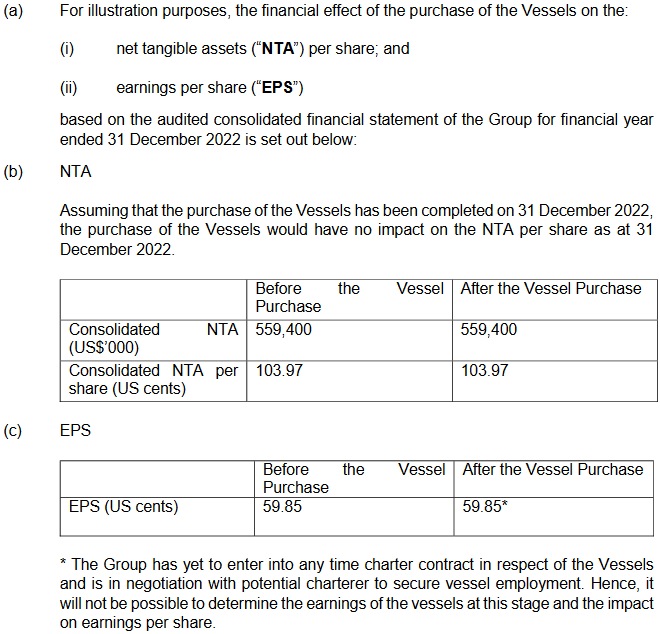

5. FINANCIAL INFORMATION AND EFFECTS

6. RATIONALE FOR THE VESSEL PURCHASE

The purchase of the Vessels will enable the Group to expand its fleet of vessels. With increased vessel on its fleet, the Group will be able to enter into more charter contract(s). In additional, the Group will be able to enter into the growing Ethylene market in Indonesia which is mainly used as a feedstock of various petrochemical plants in Indonesia & globally.

7. INTERESTS OF DIRECTORS AND CONTROLLING SHAREHOLDERS

None of the directors or controlling shareholders of the Company has any interest in the Vessel Purchase.

8. OTHER INFORMATION

(a) No person has been or is proposed to be appointed as director of the Company in connection with the Vessel Purchase. Accordingly, no service contract has been or is proposed to be entered into between the Company and any such person. (b) Copies of the memorandums of agreement for the Vessel Purchase is available for inspection at the Company's registered office at 6 Raffles Quay #25-01 Singapore 048580 for a period of three (3) months from the date of this announcement.

By order of the Board

Bani Maulana Mulia

Executive Director, Group Chief Executive Officer

27 December 2023

Samudera Shipping Line Ltd press release