|

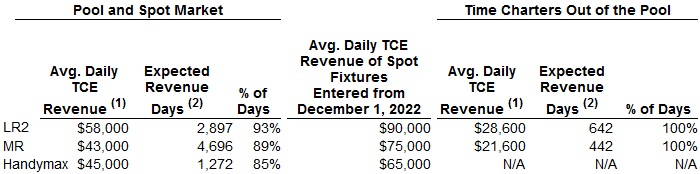

Monaco - Dec. 14, 2022 Scorpio Tankers Inc. (NYSE:STNG) ("Scorpio Tankers," or the "Company") announces an update on Q4 2022 events, including the quarter to date Daily TCE Revenues. The Company will also host a conference call at 8:30am Eastern Standard Time and 2:30pm Central European Time on December 14, 2022, the details of which are below. Fourth Quarter of 2022 Daily Time Charter Equivalent ("TCE") Revenues Below is a summary of the daily Time Charter Equivalent ("TCE") revenue and duration of contracted voyages and time charters for the Company's vessels (both in the pools and outside of the pools) thus far in the fourth quarter of 2022 as of the date hereof:

(1) TCE revenue, a Non-IFRS measure, is vessel revenues less voyage expenses (including bunkers and port charges). TCE revenue is included herein because it is a standard shipping industry performance measure used primarily to compare period-to-period changes in a shipping company's performance irrespective of changes in the mix of charter types (i.e., spot charters, time charters, and pool charters), and it provides useful information to investors and management. (2) Expected Revenue Days are the total number of calendar days in the quarter for each vessel, less the total number of expected off-hire days during the period associated with major repairs or drydockings. Consequently, Expected Revenue Days represent the total number of days the vessel is expected to be available to earn revenue. Idle days, which are days when a vessel is available to earn revenue, yet is not employed, are included in revenue days. We use revenue days to show changes in net vessel revenues between periods. Time Charter Out Agreement

Exercise of Purchase Options on Six MRs The Company has given notice to exercise its purchase options on six MR product tankers (STI Battery, STI Milwaukee, STI Tribeca, STI Bronx, STI Manhattan and STI Seneca). These vessels were sold and leased back by the Company in August 2018. The leases bear interest at LIBOR plus a margin of 3.20% per annum and the purchase, which is expected to occur before the end of December 2022, will result in a debt reduction of $99.0 million for the Company. New Financing The Company has received commitments for two separate credit facilities of up to $166.5 million in aggregate. The first commitment is from a North American financial institution for a credit facility of up to $49.1 million. The credit facility is expected to be used to finance two LR2 product tankers. The credit facility has a final maturity of five years from the signing date and bears interest at SOFR plus a margin of 1.90% per annum. The second commitment is from a European financial institution for a credit facility of up to $117.4 million. The credit facility is expected to be used to finance two Handymax product tankers, four MR product tankers and one LR2 product tanker. The credit facility has a final maturity of five years from the drawdown date of each vessel and bears interest at SOFR plus a margin of 1.925% per annum. The terms and conditions of both credit facilities, including financial covenants, are similar to those set forth in the Company's existing credit facilities. The credit facilities are subject to customary conditions precedent and the execution of definitive documentation, and are expected to close within the first quarter of 2023. The proceeds of these new facilities are expected to be used to repay more expensive lease financing. Purchase of Common Shares In December 2022, the Company has purchased 559,532 of its common shares in the open market at an average price of $51.20 per share as part of its new securities repurchase program, which was authorized on October 31, 2022. There is $221.4 million of remaining availability under the new securities repurchase program, and there are 61,492,838 common shares of the Company outstanding as of the date of this press release. About Scorpio Tankers Inc. Scorpio Tankers Inc. is a provider of marine transportation of petroleum products worldwide. Scorpio Tankers Inc. currently owns, lease finances or bareboat charters-in 113 product tankers (39 LR2 tankers, 60 MR tankers and 14 Handymax tankers) with an average age of 6.9 years. Additional information about the Company is available at the Company's website www.scorpiotankers.com, which is not a part of this press release. Scorpio Tankers Inc. press release

|