|

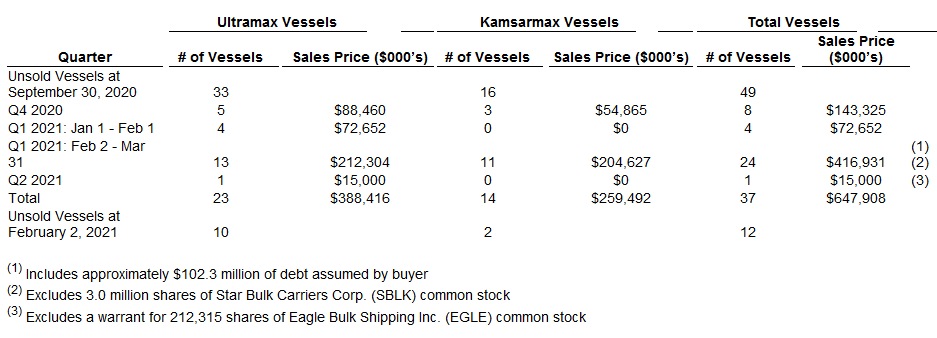

Monaco - Feb. 02, 2021 Scorpio Bulkers Inc. (NYSE: SALT) (“Scorpio Bulkers” or the “Company”), today reported its results for the three months ended December 31, 2020. The Company also announced that on January 29, 2021 its Board of Directors declared a quarterly cash dividend of $0.05 per share on the Company’s common shares. Share and per share results included herein have been retroactively adjusted to reflect the one-for-ten reverse stock split of the Company’s common shares, which took effect on April 7, 2020. Results for the Three and Twelve Months Ended December 31, 2020 and 2019 For the fourth quarter of 2020, the Company’s GAAP net loss was $465.6 million, or $40.90 per diluted share, including: • a write-down of assets of approximately $458.8 million, or $40.30 per diluted share, related to the Company’s previously announced plan to exit the dry bulk industry; • the write-off of $2.7 million, or $0.24 per diluted share, of deferred financing costs on repaid credit facilities related to vessels that have been sold; and • a non-cash gain of approximately $0.3 million and cash dividend income of $0.2 million, or $0.04 per diluted share, from the Company’s equity investment in Scorpio Tankers Inc. For the same period in 2019, the Company’s GAAP net income was $15.1 million, or $2.15 per diluted share. These results include a non-cash gain of approximately $46.1 million and cash dividend income of $0.5 million, or $6.64 per diluted share, from the Company’s equity investment in Scorpio Tankers Inc., a write-down of approximately $25.2 million, or $3.59 per diluted share, related to the classification of four Ultramax vessels as held for sale, and the write-off of deferred financing costs of approximately $0.2 million. Total vessel revenues for the fourth quarter of 2020 were $50.1 million, compared to $60.3 million for the same period in 2019. Earnings before interest, taxes, depreciation and amortization (“EBITDA”) for the fourth quarter of 2020 was a loss of $445.1 million and EBITDA for the fourth quarter of 2019 was $41.5 million, respectively (see Non-GAAP Financial Measures below). For the fourth quarter of 2020, the Company’s adjusted net loss was $4.1 million, or $0.36 adjusted per diluted share, which excludes the impact of the write-down of assets of approximately $458.8 million related to the Company’s previously announced plan to exit the dry bulk industry and the write-off of $2.7 million of deferred financing costs on repaid credit facilities related to vessels that have been sold. Adjusted EBITDA for the fourth quarter of 2020 was $13.7 million (see Non-GAAP Financial Measures below). For the fourth quarter of 2019, the Company’s adjusted net income was $40.6 million, or $5.77 adjusted per diluted share, which excludes the write-down of approximately $25.2 million related to the classification of four Ultramax vessels as held for sale, and the write-off of deferred financing costs of approximately $0.2 million. Adjusted EBITDA for the fourth quarter of 2019 was $66.7 million (see Non-GAAP Financial Measures below). For the twelve months of 2020, the Company’s GAAP net loss was $672.0 million, or $70.85 per diluted share, including: • a write-down on assets sold and classified as held for sale of approximately $495.4 million, or $52.24 per diluted share; • a loss of approximately $106.5 million and cash dividend income of $1.1 million, or $11.11 per diluted share, from the Company’s equity investment in Scorpio Tankers Inc.; and • a write-off of approximately $3.1 million, or $0.33 per diluted share, of deferred financing costs on the credit facilities related to repaid debt on vessels that have been sold. For the twelve months of 2019, the Company’s GAAP net income was $44.7 million, or $6.42 per diluted share. These results include a non-cash gain of approximately $114.7 million and cash dividend income of $2.2 million, or $16.82 per diluted share, from the Company’s equity investment in Scorpio Tankers Inc., a write-down of assets either sold or held for sale and write-off of related deferred financing costs totaling approximately $38.0 million, or $5.46 per diluted share, and the write-off of deferred financing costs of approximately $3.1 million, or $0.45 per diluted share. Total vessel revenues for the twelve months of 2020 were $163.7 million, compared to $224.6 million for the same period in 2019. EBITDA for the twelve months of 2020 was a loss of $579.7 million and EBITDA for the twelve months of 2019 was $158.3 million (see Non-GAAP Financial Measures below). For the twelve months of 2020, the Company’s adjusted net loss was $173.5 million, or $18.28 adjusted per diluted share, which excludes the impact of the write-down of assets of approximately $495.4 million and the write-off of deferred financing costs on credit facilities related to sold vessels of approximately $3.1 million. Adjusted EBITDA for the twelve months of 2020 was a loss of $84.3 million (see Non-GAAP Financial Measures below). For the twelve months of 2019, the Company’s adjusted net income was $82.6 million, or $11.88 adjusted per diluted share, which excludes the impact of the write-down of assets of approximately $37.3 million and the write-off of related deferred financing costs of approximately $0.7 million. Adjusted EBITDA for the twelve months of 2019 was $195.6 million (see Non-GAAP Financial Measures below). TCE Revenue TCE Revenue Earned during the Fourth Quarter of 2020 (see Non-GAAP Financial Measures) • Our Kamsarmax fleet (which includes both scrubber fitted and non-scrubber fitted vessels) earned an average of $10,303 TCE revenue per day. • Our Ultramax fleet (which includes both scrubber fitted and non-scrubber fitted vessels) earned an average of $10,637 TCE revenue per day. Cash and Cash Equivalents As of February 1, 2021, the Company had approximately $101.3 million in cash and cash equivalents. Recent Significant Events Dry Bulk Exit During December 2020, the Company’s Board of Directors authorized the Company, as part of its transition to a sustainable future, to sell its remaining dry bulk vessels and exit the dry bulk sector during 2021. As a result of this decision, the Company recorded a write-down on its assets of $478.4 million during the third and fourth quarters of 2020 to bring the carrying value of the assets held for sale to their fair value less selling costs. The Company also wrote off $2.7 million of deferred financing costs during the fourth quarter of 2020 related to repaid debt on vessels sold and expects further write-offs in 2021 as debt is repaid. Emanuele A. Lauro, Chairman and Chief Executive Officer, commented, “Since we announced our transition, we have concluded the sale of twelve vessels, and we have committed a further 25 vessels for sale within the first half of 2021. We expect to have committed all of our vessels for sale very shortly, allowing us to fully focus on our future in renewable energy.” Sale of Seven Vessels Today the Company announced that it has entered into an agreement with Star Bulk Carriers Corp. (“Star Bulk”) to sell SBI Pegasus, SBI Subaru and SBI Ursa, Ultramax bulk carriers built in 2015, SBI Capoeira and SBI Carioca, Kamsarmax bulk carriers built in 2015, and SBI Lambada and SBI Macarena, Kamsarmax bulk carriers built in 2016, for the aggregate consideration of three million common shares in Star Bulk which will be issued to the Company. As part of the transaction, which is expected to close within the first and second quarters of 2021, existing lease finance arrangements amounting to approximately $102.3 million would be assumed by Star Bulk. The sales are subject to approval from the existing financiers and the execution of definitive documentation. The following table summarizes when the Company delivered or expects to deliver the vessels agreed to be sold to their respective buyers.

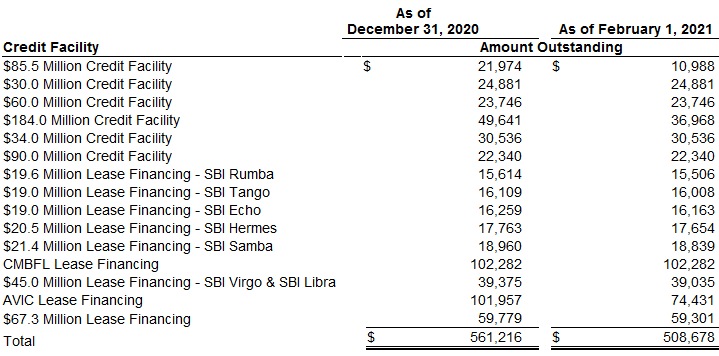

Quarterly Cash Dividend In the fourth quarter of 2020, the Company’s Board of Directors declared and the Company paid a quarterly cash dividend of $0.05 per share totaling approximately $0.6 million. On January 29, 2021, the Company’s Board of Directors declared a quarterly cash dividend of $0.05 per share, payable on or about March 12, 2021, to all shareholders of record as of February 12, 2021. As of February 1, 2021, 11,269,473 shares were outstanding. Share Repurchase Program During the fourth quarter of 2020, the Company repurchased approximately 1.1 million shares of the Company’s common stock, at an average cost of $15.52 per share. The Company subsequently repurchased approximately 41,000 shares of the Company’s common stock at an average cost of $16.96 per share from January 1, 2021 through February 1, 2021. These repurchases, totaling $17.4 million, were made under the Board of Directors authorized share repurchase program and funded from available cash resources. As of February 1, 2021, the Company had $32.6 million authorized remaining available under the authorized share repurchase program. COVID-19 Since the beginning of the calendar year 2020, the ongoing outbreak of the novel coronavirus (COVID-19) that originated in China in December 2019 and that has spread to most developed nations of the world has resulted in numerous actions taken by governments and governmental agencies in an attempt to mitigate the spread of the virus. These measures have resulted in a significant reduction in global economic activity and extreme volatility in the global financial and commodities markets. With respect to our current drybulk operations, a significant reduction in manufacturing and other economic activities has and is expected to continue to have a materially adverse impact on the global demand for raw materials, coal and other bulk cargoes that our customers transport on our vessels. This significant decline in the demand for dry bulk tonnage may materially and adversely impact our ability to profitably charter our vessels. When these measures and the resulting economic impact will end and what the long-term impact of such measures on the global economy will be are not known at this time. As a result, the extent to which COVID-19 will impact the Company’s results of operations and financial condition, including its planned transition towards marine-based renewable energy, will depend on future developments, which are highly uncertain and cannot be predicted. Debt Overview The Company’s outstanding debt balances, gross of unamortized deferred financing costs as of December 31, 2020 and February 1, 2021, are as follows (dollars in thousands):

Financial Results for the Three Months Ended December 31, 2020 Compared to the Three Months Ended December 31, 2019 For the fourth quarter of 2020, the Company’s GAAP net loss was $465.6 million, or $40.90 per diluted share, compared to a GAAP net income of $15.1 million, or $2.15 per diluted share, for the same period in 2019. Results for the fourth quarter of 2020 include: • a write-down of assets of approximately $458.8 million, or $40.30 per diluted share, related to the Company’s previously announced plan to exit the dry bulk industry; the write-off of $2.7 million, or $0.24 per diluted share, of deferred financing costs on repaid credit facilities related to vessels that have been sold; and • a non-cash gain of approximately $0.3 million and cash dividend income of $0.2 million, or $0.04 per diluted share, from the Company’s equity investment in Scorpio Tankers Inc. EBITDA for the fourth quarters of 2020 and 2019 were a loss of $445.1 million and a gain of $41.5 million, respectively (see Non-GAAP Financial Measures below). For the fourth quarter of 2020, the Company’s adjusted net loss was $4.1 million, or $0.36 adjusted per diluted share, which excludes the impact of the write-down of assets of approximately $458.8 million related to the Company’s previously announced plan to exit the dry bulk industry and the write-off of $2.7 million of deferred financing costs on repaid credit facilities related to vessels that have been sold. Adjusted EBITDA for the fourth quarter of 2020 was $13.7 million (see Non-GAAP Financial Measures below). For the fourth quarter of 2019, the Company’s adjusted net income was $40.6 million, or $5.77 adjusted per diluted share, which excludes the write-down of approximately $25.2 million related to the classification of four Ultramax vessels as held for sale, and the write-off of deferred financing costs of approximately $0.2 million. Adjusted EBITDA for the fourth quarter of 2019 was $66.7 million (see Non-GAAP Financial Measures below). The Company’s vessel revenues for the fourth quarter of 2020 were $50.1 million, compared to $60.3 million in the fourth quarter of 2019. The Company’s TCE revenue (see Non-GAAP Financial Measures below) for the fourth quarter of 2020 was $44.6 million, a decrease of $12.3 million from the prior year period. Total operating expenses for the fourth quarter of 2020 were $506.6 million, including the write-down of assets of approximately $458.8 million, compared to total operating expenses of $80.9 million in the fourth quarter of 2019, which also included a write-down of assets of $25.2 million. Full rpeort Scorpio Bulkers Inc. press release

|