|

SFL - Sale of vessel and charter termination

compensation from Frontline

October 16, 2012

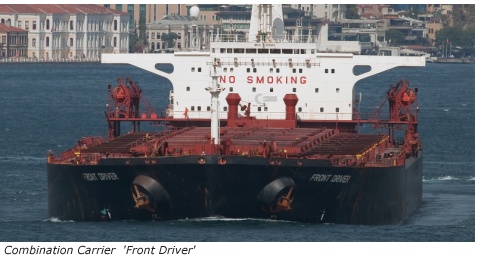

Ship Finance International Limited (NYSE:SFL) ("Ship Finance" or the "Company"), today announced that it has agreed to sell the 21-year old combination carrier Front Driver to an unrelated third party and has simultaneously agreed to terminate the corresponding charter party with a subsidiary of Frontline Ltd. ("Frontline").

Ship Finance International Limited (NYSE:SFL) ("Ship Finance" or the "Company"), today announced that it has agreed to sell the 21-year old combination carrier Front Driver to an unrelated third party and has simultaneously agreed to terminate the corresponding charter party with a subsidiary of Frontline Ltd. ("Frontline").

Delivery to the new owner is expected to be in the fourth quarter of 2012 and Ship Finance expects to receive net proceeds of approximately $9.6 million including a $0.5 million charter termination compensation payment from Frontline. As a result of the sale, the Company expects to record a book gain of approximately $3.3 million in the fourth quarter of 2012.

About Ship Finance

Ship Finance is a leading ship-owning company with one of the largest and most diverse asset bases across the maritime and offshore industries. It is listed on the New York Stock Exchange and trades under the symbol "SFL" Including newbuildings, the Company has a fleet of 66 vessels that consists of 25 crude oil tankers (VLCC and Suezmax), two chemical tankers, three oil/bulk/ore vessels, 11 drybulk carriers including, two newbuildings, 15 container vessels including, four newbuildings, six offshore supply vessels, one jack-up drilling rig, one ultra-deepwater drillship and two ultra-deepwater semi-submersible drilling rigs. Most of the vessels and offshore drilling units are employed on long-term charters. More information can be found on the Company's website: www.shipfinance.org

Ship Finance International Limited

|