|

Athens, Greece, February 18, 2025

Star Bulk Carriers Corp. (the "Company" or "Star Bulk") (Nasdaq: SBLK), a global shipping company focusing on the transportation of dry bulk cargoes, today announced its unaudited financial and operating results for the fourth quarter of 2024 and the year ended December 31, 2024.

Unless otherwise indicated or unless the context requires otherwise, all references in this press release to "we," "us," "our," or similar references, mean Star Bulk Carriers Corp. and, where applicable, its consolidated subsidiaries.

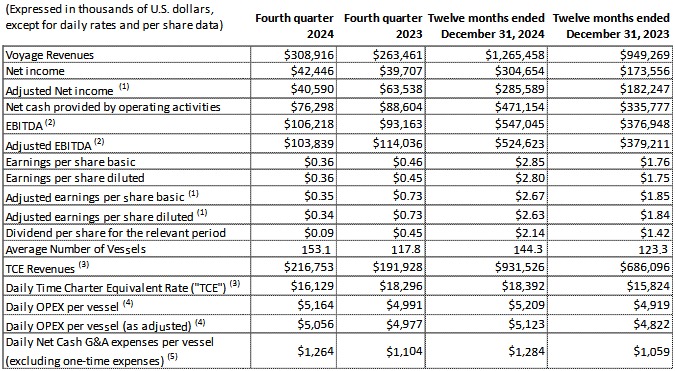

Financial Highlights

|

|

(2) EBITDA and Adjusted EBITDA are non-GAAP liquidity measures. Please see EXHIBIT I at the end of this release for a reconciliation of EBITDA and Adjusted EBITDA to Net Cash Provided by / (Used in) Operating Activities, which is the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP, as well as for the definition of each measure. To derive Adjusted EBITDA from EBITDA, we exclude certain non-cash gains / (losses) and one-time expenses.

(3) Daily Time Charter Equivalent Rate ("TCE") and TCE Revenues are non-GAAP measures. Please see EXHIBIT I at the end of this release for a reconciliation to Voyage Revenues, which is the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP. The definition of each measure is provided in footnote (7) to the Summary of Selected Data table below.

(4) Daily OPEX per vessel is calculated by dividing vessel operating expenses by Ownership days (defined below). Daily OPEX per vessel (as adjusted) is calculated by dividing vessel operating expenses excluding increased costs due to the COVID-19 pandemic or pre-delivery expenses for each vessel on acquisition or change of management, if any, by Ownership days. In the future we may incur expenses that are the same as or similar to certain expenses (as described above) that were previously excluded.

(5) Daily Net Cash G&A expenses per vessel is calculated by (1) adding the Management fee expense to the General and Administrative expenses, net of share-based compensation expense and other non-cash charges and one-time expenses and (2) then dividing the result by the sum of Ownership days and Charter-in days (defined below). Please see EXHIBIT I at the end of this release for a reconciliation to General and administrative expenses, which is the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP.

Petros Pappas, Chief Executive Officer of Star Bulk, commented:

"Star Bulk reported for the fourth quarter of 2024 Net Income of $42.4 million, TCE Revenues of $216.8 million and EBITDA of $106.2 million. Recently, we announced an amended dividend policy alongside a new $100.0 million share repurchase authorization. Under this policy, the Company may allocate up to 60% of excess cash flow towards dividends, with the remainder reserved for opportunistic share buybacks, growth initiatives and fleet renewal. For this quarter, excess cash flow amounted to $17.6 million. Our Board of Directors has approved a dividend distribution of $0.09 per share, and we spent over $7.4 million to repurchase 500,000 shares in January. Overall, we have repurchased approximately 900,000 shares since the renewal of our share repurchase program.

On the operational front, we have made significant progress in integrating systems and processes, creating a best-in-class ship-owning and management platform that combines the strengths of both Star Bulk and ex-Eagle Bulk. Delivering on our commitment to synergies, we have cumulatively reduced costs by $21.8 million since April 2024. Notably, this quarter alone, we achieved $12.6 million in cost reductions—equivalent to an annualized run rate of over $50.0 million—an important milestone reached ahead of schedule.

From a financing perspective, we continue to benefit from strong interest by major financial institutions in lending to Star Bulk. We have successfully raised new debt and refinanced existing facilities on highly attractive terms, reducing costs while extending maturities.

As environmental regulations become increasingly stringent, Star Bulk continues to invest in technology, expertise and personnel both to comply with new EU environmental regulations and prepare for upcoming global mandates.

Looking ahead, while the first quarter is traditionally weaker and geopolitical uncertainties persist, we remain cautiously optimistic about the medium-term outlook for the dry bulk market. The orderbook remains low, with limited incentive for new vessel orders given current pricing and market conditions, despite an aging global fleet. With our strong balance sheet, scale, and deep industry expertise, Star Bulk is well positioned to capitalize on future opportunities and continue delivering value to our shareholders."

Recent Developments

Declaration of Dividend

On February 18, 2025, pursuant to our dividend policy, as amended and announced on December 16, 2024 (our "Dividend Policy"), our Board of Directors declared a quarterly cash dividend of $0.09 per share (corresponding to 60% of the "Cash Flow"1 of the fourth quarter of 2024), payable on or about March 18, 2025 to all shareholders of record as of March 4, 2025. Pursuant to our Dividend Policy, the remaining 40% of the "Cash Flow" of the fourth quarter 2024, has been used to buy back shares as described in the below paragraph.

Share Repurchase Program & Shares Outstanding Update

On December 13, 2024, our Board of Directors cancelled the existing $50.0 million share repurchase program and authorized a new share repurchase program of up to an aggregate of $100.0 million ("New Share Repurchase Program") on the same terms and conditions as the previous share repurchase program. Pursuant to the New Share Repurchase Program and using proceeds from previous vessel sales as well as 40% of the "Cash Flow" of the fourth quarter of 2024 (pursuant to our Dividend Policy), in December 2024 and January 2025, we repurchased 393,474 and 500,000 common shares, respectively, in open market transactions at an average price of $15.08 per share for an aggregate consideration of $13.5 million.

As of the date of this release, we have 117,127,531 shares outstanding and $86.5 million outstanding under our New Share Repurchase Program.

Fleet Update

Vessels' S&P

In connection with the previously announced vessel sales, the vessels Star Hydrus, Imperial Eagle and Diva were delivered to their new owners on November 21, 2024, November 27, 2024 and December 27, 2024, respectively. Furthermore, on February 6, 2025, we agreed to sell the vessel Bittern, which is expected to be delivered to its new owner within the second quarter of 2025.

Interest Rate Swaps

Following a number of interest rate swaps we have entered into, we currently have an outstanding total notional amount of $50.0 million under our financing agreements with an average fixed rate of 53 bps and an average remaining maturity of 1.2 years. As of December 31, 2024, the Mark-to-Market value of our outstanding interest rate swaps stood at $3.2 million, and our cumulative net realized gain amounted to $38.4 million.

Financing

In December 2024, we received credit committee approval from Taipei Fubon Commercial Bank Co., Ltd. for a loan amount of up to $43.0 million (the "Fubon $43.0 million facility"), which is expected to be drawn within the first quarter of 2025. The Fubon $43.0 million facility will mature 5 years after the drawdown and will be secured by first-priority mortgages on the currently unencumbered vessels Peloreus and Leviathan. The completion of the transaction is subject to the execution of customary definitive documentation.

In January 2025, we entered into a loan agreement with ING Bank N.V., London Branch for a loan amount of up to $185.0 million (the "ING $185.0 million facility") which we drew on January 24, 2025. The funds were used to refinance the outstanding amount of $154.9 million under the existing ING $325.6 million facility. We also prepaid the outstanding amount of $35.7 million under the remaining tranche of the existing ABN $97.1 million facility secured by the vessels Star Eva, Star Aphrodite, Star Lydia and Star Nicole, which are now unencumbered. The ING $185.0 million facility matures in January 2030 and is secured by first priority mortgages on 17 vessels which were part of the collateral vessels of the ING $325.6 million facility.

Following the prepayment of the ING $325.6 million facility, we early terminated the existing interest rate swap agreements with ING Bank N.V., London Branch, for the vessels Peloreus and Leviathan which were originally set to mature in October 2025. In connection with the early termination of the interest rate swap agreements mentioned above, we received an amount of $0.6 million in aggregate, representing the valuation of the interest rate swaps on the termination date.

In February 2025, we received a credit committee approval from ABN AMRO N.V. for a senior secured revolving facility of an amount of up to $50.0 million (the "ABN Revolving facility").

The prepayment of the outstanding amount of $7.8 million under the existing SEB $39.0 million facility, secured by the vessels Star Marilena, Star Borneo and Star Bueno, is expected to be complete by the end of February 2025. Moreover, the termination of the existing interest rate swap agreements with Skandinaviska Enskilda Banken AB for the three aforementioned vessels is also expected to be complete by the end of February 2025.

Following the completion of the refinancings and the prepayments described above, until the end of the first quarter of 2025, we will have 13 unencumbered vessels and we will have raised additional cash of approximately $28.0 million to be used for fleet renewal and general corporate purposes.

Full report

About Star Bulk

Star Bulk is a global shipping company providing worldwide seaborne transportation solutions in the dry bulk sector. Star Bulk's vessels transport major bulks, which include iron ore, minerals and grain, and minor bulks, which include bauxite, fertilizers and steel products.

Star Bulk was incorporated in the Marshall Islands on December 13, 2006 and maintains executive offices in Athens, New York, Limassol, Singapore, Germany and Denmark. Its common stock trades on the Nasdaq Global Select Market under the symbol "SBLK".

Upon the delivery to its new owners, Star Bulk will have a fleet of 153 owned vessels, with an aggregate capacity of 15.0 million dwt, consisting of Newcastlemax, Capesize, Post Panamax, Kamsarmax, Panamax, Ultramax and Supramax vessels with carrying capacities between 53,489 dwt and 209,537 dwt.

Star Bulk Carriers Corp. press release