|

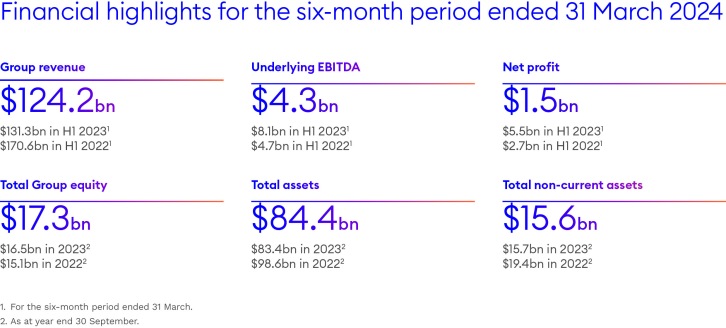

Singapore - 6 June 2024 Trafigura Group Pte Ltd ("Trafigura" or "the Group"), a market leader in the global commodities industry, today released its 2024 Half Year results for the period ended 31 March 2024. "The strength of our business was evident with robust performances from our core divisions," said Jeremy Weir, Trafigura's Executive Chairman and Chief Executive Officer. "In a less stressed environment than the same period a year ago, demand for our services remained strong and we recorded a net profit that was one of our best first half year results on record." The six months to the end of March of 2024 saw a continuation of the less turbulent conditions that prevailed during the second half of the 2023 financial year. Revenue fell five percent to USD124,197 million, reflecting the impact of lower commodity prices, partially offset by higher trading volumes. The Group reported underlying earnings before interest, tax, depreciation and amortisation (EBITDA) of USD4,284 million compared to USD8,136 million in 2023. The solid performance in the first half of 2024 demonstrates the Group's ability to adapt to changing market dynamics. The Group recorded a net profit of USD1,474 million, one of the best first half results on record. There were robust performances from all of our core divisions - Oil and Petroleum Products, Metals and Minerals, Gas Power and Renewables - as well as shipping. Demand for the Group's services remained high as customers continued to rely on Trafigura to navigate complex markets. Total traded volumes of oil and petroleum products, including natural gas and LNG, were 7.2 million barrels per day, around 15 percent above the previous year's level. This was mainly due to higher trading volumes in crude oil, driven by our supply and marketing agreements with refineries in Europe. In non-ferrous metals, volumes were almost unchanged year-on-year at 10.4 million tonnes, while bulk mineral volumes rose 25 percent to 54.7 million tonnes due to an increase in iron ore. This was due to higher throughput at the Porto Sudeste joint venture terminal in Brazil, as well as increased trade of iron ore from Australia and India. The period was not without its challenges as Nyrstar's metals processing operations continued to face lower commodity prices and high energy costs, together with significant global competition.

Acquisitions Group equity was in excess of USD17 billion at the end of March 2024, providing a solid base for investments that will help the Group benefit from and contribute to a changing global energy system. These include the planned purchase of the European assets of Greenergy, a UK-based supplier of road fuels and a major producer of biodiesel, as well as its Canadian supply operations. These acquisitions, which are subject to regulatory approval, will help strengthen Trafigura's fuel supply operations and add physical production of renewable fuels to the growing biofuels business. After the half year closed, Rhone Energies - a consortium formed by Trafigura and refinery investor Entara - announced exclusive negotiations to purchase the Fos-sur-Mer refinery in the south of France from Esso, subject to regulatory and other approvals. Collectively these acquisitions highlight Trafigura's commitment to supply the resources society needs today. Investing for the future The Group is also continuing to invest for the future. During the half-year period, the company reached an agreement to increase its shareholding in H2 Energy Europe and became its majority owner as work continues towards a final investment decision on a large-scale renewable hydrogen project in Denmark and a 20MW project in South Wales, UK. In Africa, Trafigura is part of a consortium that has been awarded a 30-year concession to operate a 1,300km rail corridor and mineral port in Angola. The Lobito Atlantic Railway offers a more efficient and competitive route to market to the Atlantic coast of Africa for minerals and metals produced in the Copperbelt region. The consortium's investment programme has commenced with major contracts signed for the acquisition of rolling stock and infrastructure. In battery metals, Trafigura has agreed to invest in a new state-of-the-art nickel refinery that Korea Zinc is building in Ulsan, South Korea, while also supplying feedstock to the plant and marketing a portion of its production. Another highlight of the 2024 half year period was an agreement to purchase carbon dioxide removal credits from a new direct air capture facility currently under construction in Texas. The Group is also actively involved in efforts to improve the sustainability of the shipping industry, which remains almost entirely dependent on fossil fuels. After the half year closed an order was made for four medium-sized gas carriers capable of running on low-carbon ammonia, supporting the commitment to reduce the carbon intensity of the Group's shipping fleet. Liquidity and financing Trafigura also continued to secure increased access to financing lines throughout the half year period, further strengthening its liquidity buffer. Total credit lines reached a record level of USD77 billion, excluding Puma Energy, from a network of around 150 financial institutions. Outlook "We are optimistic about the Group's future growth prospects and ability to deliver value for our stakeholders and more than 1,400 employee shareholders. This positive view reflects the ongoing strength of our financial position and the support we enjoy from a broad range of financial institutions globally," concluded Trafigura Group Chief Financial Officer, Christophe Salmon. To watch a video interview with Christophe Salmon, Trafigura Group CFO and Stephan Jansma, CFO Asia Pacific about the Half Year results and to download a copy of Trafigura's 2024 Half Year Report click here. About Trafigura Trafigura is a leading commodities group, owned by its employees and founded over 30 years ago. At the heart of global supply, Trafigura connects vital resources to power and build the world. We deploy infrastructure, market expertise and our worldwide logistics network to move oil and petroleum products, metals and minerals, gas and power from where they are produced to where they are needed, forming strong relationships that make supply chains more efficient, secure and sustainable. We invest in renewable energy projects and technologies to facilitate the transition to a low-carbon economy, including through H2Energy Europe and joint venture Nala Renewables. The Trafigura Group also comprises industrial assets and operating businesses including multi-metals producer Nyrstar, fuel storage and distribution company Puma Energy, and our Impala Terminals joint venture. The Group employs over 12,000 people, of which over 1,400 are shareholders and is active in 156 countries. Trafigura Group Pte. Ltd. press release

|