|

Athens, Greece - October 30, 2025

Capital Clean Energy Carriers Corp. (the "Company", "CCEC", "we" or "us") (NASDAQ: CCEC), an international owner of ocean-going vessels, today released its financial results for the third quarter ended September 30, 2025.

Key Quarterly Highlights

• New long term time charter agreement for one liquefied natural gas ("LNG") carrier ("LNG/C") under construction

• Concluded the sale of a 13,312 TEU container vessel announced in August 2025

• Secured financing for all six Dual Fuel Medium Gas Carriers ("DF MGC") and two Liquid CO2 ("LCO2") /multi-gas carriers under construction

• Completed the 5-year special surveys of LNG/Cs Aristos I and Aristidis I

• Announced dividend of $0.15 per share for the third quarter of 2025

The Company announced in November 2023 its decision to shift its strategic focus towards the transportation of various forms of gas to industrial customers, including LNG and emerging new commodities in connection with the energy transition. As a result, the Company agreed to acquire 11 newbuild LNG/Cs (the "Newbuild LNG/C Vessels") and in June 2024, the Company further expanded its gas-focused portfolio with the acquisition of 10 gas carriers, including four LCO2/multi-gas and six DF MGCs (the "Gas Fleet"). Since December 2023, the Company has also completed the sale of 13 container vessels.

In view of this strategic shift, we present our financial results on a continuing operations basis, except for where reference is made to discontinued operations. Financial results from continuing operations include revenues, expenses and cash flows arising from our 14 vessels currently in-the-water, including 12 latest generation LNG/Cs and two 13,000 twenty equivalent unit ("TEU") Neo-Panamax container vessels.

Financial results from discontinued operations include revenues, expenses and cash flows arising from the 13 container vessels we have sold following the announcement of our strategic shift in November 2023. Please refer to Appendix A Discontinued Operations.

Key Financial Highlights (continuing operations)

Management Commentary

|

|

"The third quarter has marked another period of robust performance for the Company, with significant achievements across all strategic fronts and operational priorities. The business continues to build momentum, further strengthening its position within the LNG and gas transportation sector.

The Company has successfully secured long-term employment for another LNG carrier currently under construction, well ahead of its scheduled delivery. This move not only demonstrates proactive planning but also contributes to further diversification of our customer base. The Company's total contract backlog duration now stands at 6.9 years, with $3.0 billion in contracted revenues. These figures highlight increased cash flow visibility and a de-risked balance sheet, which we believe will support the Company's financial stability.

Financing has been secured for all six DF MGCs and all four LCO2/multi-gas carriers, which underscores the Company's financial agility and commitment to its strategic objectives. In parallel, the sale of another container vessel has enabled further recycling of the capital base with the proceeds being reinvested into the Company's under-construction fleet of gas shipping assets.

Corporate governance continues to evolve, with changes in our Board of Directors. The Company expresses gratitude to Abel Rasterhoff for his service since our U.S. listing in 2007 and wishes him well in retirement. Martin Houston is welcomed to our Board, bringing unparalleled experience and stature in the LNG market.

It has been just two years since the Company began its journey focused on gas transportation, following a rights issue in November 2023. Out of an eventual fleet of 18 LNG/Cs, CCEC now only has three latest generation LNG/Cs under construction that remain available for charter. Discussions regarding their future employment are underway with multiple counterparties, while the Company remains insulated from prevailing spot LNG market conditions for the next 12 months.

By consistently executing on its strategy, CCEC is well on its way to becoming the largest US-listed company dedicated to LNG and gas transportation."

Fleet Employment Update

CCEC has secured employment for the LNG/C Athlos, 174,000 Cubic Meters ("CBM") currently under construction at Hyundai Samho, which is scheduled for delivery from the shipyard in the first quarter of 2027.

In particular, the LNG/C Athlos has been chartered for a firm period of seven years by a major energy company, with three one-year options. Commencement of the charter is scheduled for the first quarter of 2028. Importantly, CCEC maintains the right to substitute the LNG/C Athlos with the LNG/C Archon (174,000 CBM currently under construction at Hyundai Samho and also scheduled for delivery from the shipyard in the first quarter of 2027), further increasing our commercial flexibility.

As a result, CCEC now has an average remaining firm charter duration of 6.9 years and $3.0 billion in contracted revenues. Should all extension options be exercised by charterers, the average duration would increase to 9.8 years, with total contracted revenues rising to $4.4 billion.

Overview of Third Quarter 2025 Results

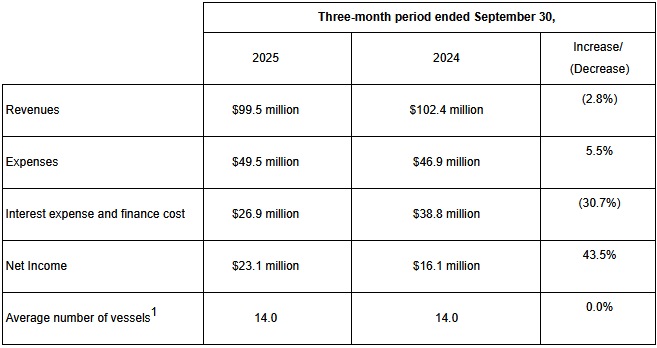

Net income for the quarter ended September 30, 2025, was $23.1 million, compared with net income of $16.1 million for the third quarter of 2024.

Total revenue for the quarter ended September 30, 2025, was $99.5 million, compared to $102.4 million during the third quarter of 2024. The decrease in revenue was attributable to the off-hire periods related to the five-year special surveys underwent by LNG/Cs Aristos I and Aristidis I during the quarter, partly offset by the commencement of the long-term bareboat charter of Axios II in the first quarter of 2025.

Total expenses for the quarter ended September 30, 2025, were $49.5 million, compared to $46.9 million in the third quarter of 2024. Total vessel operating expenses during the third quarter of 2025 amounted to $20.5 million, compared to $16.3 million during the third quarter of 2024. The increase in vessel operating expenses was mainly due to expenses related to the special surveys of LNG/Cs Aristos I and Aristidis I, which were completed during the third quarter of 2025. Total expenses for the third quarter of 2025 also include vessel depreciation and amortization of $23.1 million, in line with the third quarter of 2024. General and administrative expenses for the third quarter of 2025 amounted to $3.6 million, compared with $4.7 million in the third quarter of 2024, on the back of lower transaction-related costs, partly offset by higher costs incurred in connection with our equity compensation incentive plan.

Total other expenses, net for the quarter ended September 30, 2025, were $26.9 million compared to $39.5 million incurred in the third quarter of 2024. Total other expenses, net include interest expense and finance cost of $26.9 million for the third quarter of 2025, compared to $38.8 million for the third quarter of 2024. The decrease in interest expense and finance cost was mainly attributable to the decrease in our average indebtedness and the weighted average interest rate charged on our debt compared to the third quarter of last year.

Company Capitalization

As of September 30, 2025, total cash amounted to $332.3 million. Total cash includes restricted cash of $21.5 million, which represents the minimum liquidity requirement under our financing arrangements.

As of September 30, 2025, the Company's total shareholders' equity amounted to $1,462.9 million, an increase of $119.9 million compared to $1,343.0 million as of December 31, 2024. The increase for the nine months to September 30, 2025 reflects net income (including net income from discontinued operations) of $134.2 million, amortization associated with the equity incentive plan of $4.3 million, net proceeds of $0.2 million under the Company's ATM Program (as defined below) and $8.1 million of common shares issued under our Dividend Reinvestment Plan net of expenses, partly offset by dividends declared during the period in a total amount of $26.6 million and other comprehensive loss of $0.3 million relating to the net effect of the cross-currency swap agreement we designated as an accounting hedge.

As of September 30, 2025, the Company's total debt was $2,440.8 million before deferred financing costs, reflecting a decrease of $63.2 million compared to $2,504.0 million as of December 31, 2024. The decrease is attributable to the scheduled principal payments for the period of $95.2 million, partly offset by a $32.1 million increase in the U.S. Dollar equivalent, as of September 30, 2025, of the euro-denominated bonds issued by CPLP Shipping Holdings Plc in July 2022 and October 2021.

As of September 30, 2025, the weighted average margin on our floating debt, including discontinued operations, amounting to $2,004.2 million was 1.8% over SOFR and the weighted average interest rate on our fixed rate debt amounting to $527.0 million was 4.5%.

Container Divestment Update

On August 7, 2025, the Company entered into a memorandum of agreement for the sale of M/V Manzanillo Express (142,411 DWT / 13,312 TEU, hybrid scrubber-fitted, eco container vessel, built 2022, Hyundai Samho Industries Co. Ltd, South Korea). The vessel was delivered to its new owner on October 6, 2025.

The Company expects to record a gain of approximately $7.5 million from the sale. The proceeds were used to pay down outstanding debt of $90.4 million, and for general corporate purposes.

The completion of this transaction leaves CCEC with only two 13,000 TEU container vessels - both on long term time charters through 2033, with options to extend to 2039. This vessel sale aligns with the Company's strategic plan, announced in November 2023, to shift its strategic focus towards the transportation of various forms of gas to industrial customers, including LNG and emerging new commodities in connection with the energy transition. Since February 2024, CCEC has sold 13 container vessels, generating gross proceeds of approximately $694.2 million.

Under-Construction Fleet Update

The Company's under-construction fleet includes six latest generation LNG/Cs (comprising the remaining Newbuild LNG/C Vessels that have not yet been delivered to the Company) and the Gas Fleet. The following table sets out the Company's schedule of expected capex payments for its under-construction fleet as of September 30, 2025.

Full report

About Capital Clean Energy Carriers Corp.

Capital Clean Energy Carriers Corp. (NASDAQ: CCEC), an international shipping company, is one of the world's leading platforms of gas carriage solutions with a focus on energy transition. CCEC's in-the-water fleet includes 15 high specification vessels, including 12 latest generation LNG/Cs and three legacy Neo-Panamax container vessels, one of which is expected to be sold during the third quarter of 2025. In addition, CCEC's under-construction fleet includes six additional latest generation LNG/Cs, six dual-fuel medium gas carriers and four handy LCO2/multi-gas carriers, to be delivered between the first quarter of 2026 and the third quarter of 2027.

For more information about the Company, please visit: www.capitalcleanenergycarriers.com

Capital Clean Energy Carriers Corp. press release